HAUTE AUCTION

As much as fine jewelry is a treasured gift or personal memento, it’s also a savvy investment.

Here, one industry leader explains why a collection of precious gems might just be your portfolio’s best friend— and how to start building your own.

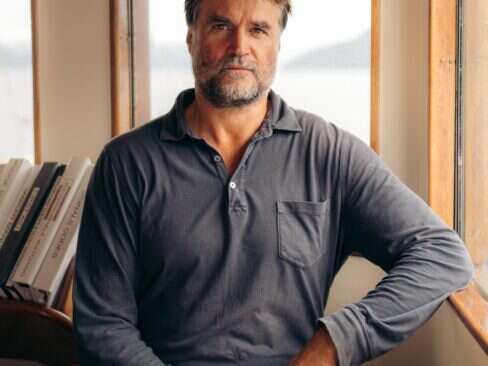

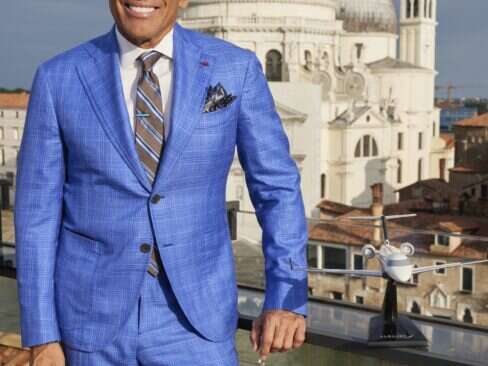

Christie’s is the world’s premier auction house, and one of the most important resources for collectors of fine jewelry, with an impressive 26 sales a year in major cities around the world. Elite Traveler spoke with Rahul Kadakia, the head of Christie’s New York jewelry department, to learn more about buying and selling, market trends and, of course, the recordbreaking Elizabeth Taylor auction.

HOW DID YOU GET STARTED IN THE JEWELRY INDUSTRY AND AT CHRISTIE’S?

I come from a family of jewelers—I worked with my family for five years in Bombay, where we have a jewelry store. I went on to study gemology at the GIA in Los Angeles. Christie’s recruited a few young students in 1996 and I’ve been with the company ever since. They started me at Christie’s London for a year, then Geneva, where we have our major flagship jewelry auctions, until 2004, when I moved to New York and became the head of the jewelry department here.

CAN YOU DESCRIBE THE APPRAISAL PROCESS?

It’s very easy. Clients can call or email their “local” Christie’s—we have jewelry specialists in Amsterdam, Berlin, Beijing, Dubai, Geneva, Hong Kong, London, Los Angeles, New York, Paris, Rome, all over the world—and describe what it is they’re looking to sell or send an image, with as many details as possible. One of our specialists will get back to you within 24 hours to set up an appointment or give you a preliminary idea of what your piece might be worth. We see roughly 100 appraisal requests a month and sell about 10,000 to 15,000 jewels each year—be it an individual stone, a piece of jewelry or a suite. We’re looking at jewelry all day, every day.

HOW DO CHRISTIE’S JEWELRY SPECIALISTS CHOOSE THE BEST LOCATION TO SELL A PARTICULAR PIECE?HOW DO THEY SET PRICING?

There are certainly trends and local tastes—for example, there could be a provenance for a certain jewel in a particular part of the world. We also look at import and export implications for different countries; sometimes it’s better to sell a piece in the country it originates from. In terms of how we set pricing, for diamonds, we look at the 4 Cs. For rubies, sapphires and emeralds, we also look at size, color, purity, whether or not it’s set in a jewel and what we have sold that is similar. Natural pearls are also at an all-time high right now. We take into account market trends and we track prices— we don’t want to price too high or too low, we want to peg it just right in order to achieve the best results.

WHY DO YOU THINK AUCTIONS ARE STILL A POPULAR WAY TO PURCHASE JEWELRY, WITH THE WEALTH OF BOUTIQUES, DEPARTMENT STORES AND EVEN E-COMMERCE AVAILABLE TO CONSUMERS?

I think auctions are the most transparent way of buying whatever you wish to sell—be it cars, wine, timepieces or fine jewelry. It’s public, and you pay the highest public price that needs to be paid. You know exactly what’s going on because you’re in the room, and you know that you’re paying market prices. Also, auction houses vet every single jewel they sell, so there’s an important element of trust. You can be sure that a specialist has carefully looked at whatever they’re selling and assessed it based on market trends.

DO YOU HAVE ANY TIPS FOR FIRST-TIME BUYERS LOOKING TO PURCHASE PIECES AT AN AUCTION?

First decide what it is you’re buying and what you’re buying it for—is it a birthday present, an engagement ring, an important anniversary? Then speak with a specialist and have them help you—that’s the best part of buying from an auction house. A specialist will help you assess quality, price trends, and provide bidding advice. Ask questions—that’s what they’re here for. You can also come in to an auction and not buy anything, just sit and watch what happens and get acquainted with the process before you buy.

HOW IMPORTANT IS PROVENANCE, ESPECIALLY IN OUR CELEBRITY-OBSESSED CULTURE?

To give you an example: In December 2011, Elizabeth Taylor’s private collection was auctioned off. The total estimate going into the sale was $14 million, but it was actually sold for $144 million. There’s your answer right there. This November in Geneva we have another very important sale with a 76-carat—that’s larger than a quail egg—D color, flawless diamond, known as the “Archduke Joseph” diamond. The quality of the stone alone is very important, but the fact that it belonged to one of the most important royals in all of Europe greatly increases its value. The diamond was purchased for $6.5 million at Christie’s in Geneva in 1993 and is now estimated to sell for $15 to $25 million. I don’t know too many other investments that give you a 200 percent return in 19 years.

WHAT ARE SOME OF THE TRENDS YOU’RE SEEING AT THESE SALES? WHAT KINDS OF PIECES ARE SELLING THE BEST?

In October we achieved a $50 million sale in a single day in New York. Some of the top sellers were a 50-carat D cut flawless diamond, which made $9.4 million, and a double strand of natural pearls that made about $3.7 million. Signed vintage jewelry by top houses like Boucheron and Cartier often make two to three times the estimated price. I would say the top points buyers are looking for are quality, important or significant gems, and natural pearls. The house name is also very important. An extraordinary stone set by Van Cleef & Arpels, for example, will attract more attention because people perceive these pieces as bearing the house’s signature stamp.

DO YOU HAVE ANY MEMORABLE PIECES OR SALES FROM RECENT YEARS?

The Elizabeth Taylor auction was by far the most important event in auction history, truly in its own class. Every other lot achieved records, and it was the most expensive jewelry auction that has ever been held. Being in that room was a great high. It was such a record-breaker because the jewelry was fantastic—with pieces from Cartier, Boucheron, every major house, the very best of every facet of the jewelry world—but also because Elizabeth Taylor was a humanitarian, with so much romance in her life. People loved her for who she was, which spilled over into the jewelry. The best diamond, the Elizabeth Taylor diamond, made almost $9 million dollars.

WHAT’S YOUR TAKE ON JEWELRY AS AN INVESTMENT? DO YOU SEE A LOT OF PEOPLE COMING IN TO BUY JEWELRY AS AN INVESTMENT, AS OPPOSED TO JUST A GIFT OR ACCESSORY?

I think jewelry is a very personal purchase for everyone, because it’s pretty much always bought for very special occasions. The majority of our jewelry sales are to collectors who buy for special reasons. Jewelry is beautiful and it makes people happy. But it’s also a very portable form of wealth—there is also that level of jewelry buying. People who wear these big jewels, be they celebrities, royalty, what have you, might wear them because they love them—but they cannot discount the fact that a little investment is always in your thoughts with a major jewelry purchase.