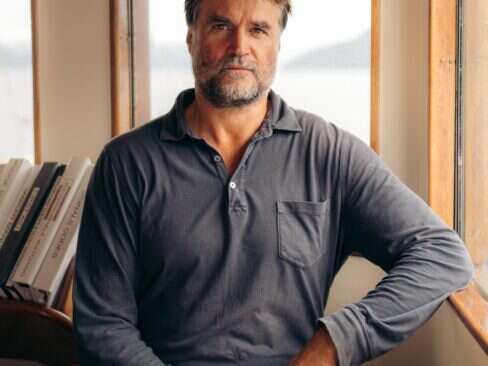

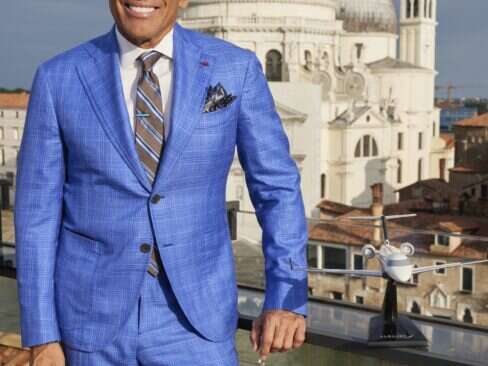

Executive Vice President, AmericasBritish Airways

Though he planned to work with British Airways for only a couple of years after graduating university, Simon Talling-Smith enters his 18th year with the company in a new post as Executive Vice President, Americas, overseeing its most important long-haul region for revenues and profits in perhaps the most challenging environment since the airline privatized in the mid-80s. Talling-Smith recently sat down with Elite Traveler Editor-in-Chief, Douglas Gollan, to discuss how the airline plans to make it through the turbulence while still providing a high level of service to its customers, as well as expansion plans based on its proposed joint venture with American Airlines and Iberia, new products and lessons learned from the opening last year of Terminal 5.

ET: Could you give us a little bit of background on your career history?

Simon Talling-Smith:I joined BA straight from Oxford. When I was leaving the university, I looked for big blue chip companies who ran recognized management training programs, and I figured I’d come and do it for a year. It gave me a chance to do a lot of very interesting things, and as part of the BA program you had to do everything.

I managed ba.com for many years, and I most recently managed our cabin crew, which is really the face of the airline and a great group of people to work with, very colorful. In many ways, probably the best-known part of the BA brand is the onboard service.

So I started in September of last year running BA’s business across North and South America. We have a pretty tough revenue challenge here in the operation of all our airports and the service we deliver to our customers, as in check-in, catering, et cetera. We have a pretty substantial call center as well in Jacksonville, Florida, so it’s quite a big business.

ET: What percent of BA’s business does this represent?

Simon Talling-Smith:We’re probably about 20 percent of the company’s revenue. The UK is about 45 percent of the company’s revenue. Then after that, America probably is the biggest region, then Europe, and then Asia Pacific and Africa. What really matters to the company about the Americas is the profitability so the important thing is that we derive the vast share of the company’s profit on routes in and out of North America.

ET: You mentioned it’s a difficult environment. So maybe talk a little bit about some of the things that BA is doing in terms of preparing your business for a difficult period.

Simon Talling-Smith:The first thing that we are doing, and most airlines I can see are doing, is trying to align our capacity with demand. So, if you are going to have any chance of getting through the downturn, you want to at least make sure that you’re not overproducing. The difficult thing, of course for airlines, particularly airlines like BA, is that you have an existing commitment of assets. Also we have slots at Heathrow, which are essentially assets to us as well. So, you can’t just kind of park all of that stuff. Therefore, you’re trading off, wanting to fly as much of your aircraft as possible against the demand that’s actually there.

We currently trimmed about four percent of our capacity to the Americas. Once you’ve done that, once you’ve trimmed the capacity and you have the right number of people, then I think the focus has to be on taking cost out of the organization. One of the things that BA is trying to do as much as possible is take costs out that don’t affect our customers. Our business model is based on a very high product and service, and our belief is to provide the best product and service, and people will pay for that.

If we are going to retain our business model then we have to make sure that we keep spending the right amount of money on our customer product, that we don’t start charging customers for things that they don’t expect to be paying for, and that we continue our investment program. BA tries to stay ahead by having some of the most innovative products and you have to spend money on them. So that means we already looked to save money, and we’re going to try to save money where the customer can’t see it, which is back office and middle management and things like that. So we just cut a third of our entire management corporation: 450 managers left the business in early December.

ET: How does that impact the way you run the business? I mean obviously these people weren’t sitting around doing nothing.

Simon Talling-Smith:No, and what we’re doing now that we’re coming towards the end of the restructuring is trying to put a new structure in place that covers the same amount of management span with less people. I am pretty confident that we’re going to be fine in our ability to run the business with our management numbers. But it’s going to be a pretty stretching time.

ET: You mentioned trying to cut in places that the customer can’t see. Are there any places that you had to cut or trim that your British Airways customers, particularly premium first and business class, are going to notice?

Simon Talling-Smith:I can’t think of any. We haven’t trimmed into our onboard product. Obviously, you look even harder for the efficiency that you didn’t find last time. For example, there’s a lot of money spent on catering onboard the aircraft, but a lot of that is not necessarily about what you offer the customer. I mean, you set as high a specification as you can and then the question is how efficiently can you produce it, and how can you get the numbers right and make sure that there is enough choice of meals, but not too much. The last thing you want to do with expensive airline food is throw it away. So you go back and revisit those things, and if you get that right, the customer doesn’t see it, and you can keep your costs under control.

ET: What about on the staffing side? Obviously, in a time of consolidation, people worry about their security and their jobs. You’re in a service business. Are there any things in particular that you’re doing to make sure that the people, particularly the ones who are in contact with the customers, are still motivated?

Simon Talling-Smith:That’s a very difficult challenge, and I think our view as a management team is that we have to be as honest as possible with our people and tell them what lies ahead, at least as much as we know. I don’t think that you can give people false hope and just make them promises that can’t be kept. The future is pretty uncertain. What we do know is that we don’t want to cut back on our frontline staff numbers to the extent that customers start to feel that they’re not being served anymore. In any large work group, there are ways to improve productivity of that group without denigrating the product at the end.

ET: Maybe you could give us a little bit of an update on premium products. I know the new Club World was rolled out last year. I guess First Class has been delayed, but you’re doing some renovations and some updates in the lounges, right?

Simon Talling-Smith:Well we are still committed to finishing the Club World rollout. So we’re still being fitted on triple-7s as we speak. Customers love that product. It’s a big investment for us, probably about $300 million US dollars, but I think it’s an important sign that BA is remaining true to its value, and we’re continuing to make the investment and not stopping to save money at all costs.

First is being delayed a little bit. We’re expecting the first one of our 747s to fly with the new product later this year, which will be good to see that out there. I think we’ll probably fly one aircraft alone for a while just to make sure we understand all of the teething problems with it. We want to solve those problems before we put it on other aircraft, which is something we haven’t done in the past. We tend to have a fairly fast rollout, and then we’re playing catch-up on early teething problems. It is noticeably more comfortable than our current first class, and the bed is bigger and the equipment is better with the same number of seats.

So you’re going to see First this year, and obviously we’re in a pretty strong position in London because we’re on the back of a very big $100 million investment in our lounges in Terminal 5, which I think are probably some of the best in the world, if not the best in the world right now. People are obviously catching up. We have plans to refurbish the lounges here in JFK too. But, again it’s a seriously big investment, probably $30 million, to completely re-fit lounges to bring them to the same standard as Terminal 5. We’re also developing a drive-up concierge check-in for First Class, which I think will really just take that to a completely new level. We’re hoping to start work on construction within this year. It does depend a bit on how the economics of the company are this year, but our plan at this stage is to start on this.

ET: Anything else new in terms of product?

Simon Talling-Smith:In the fall, we’re going to be starting direct service, business class-only service, from London City to New York JFK. Small aircraft, Airbus 318 with 32 Club World seats, right into the heart of the new business district in London where we’ve got some of our big corporate companies—like Merrill Lynch, HSBC, et cetera—who are headquartered in London and who have their London or European headquarters sitting right next to the London City Airport. That’s going to be extremely popular. Those companies are very enthusiastic about our offer. It’s a bit of a first for BA. It’s the first time we’ve flown a small jet across the Atlantic for a while. It’s the first time we’ve flown business class only. It’s going to be on the edge of the private jet market. Not private jet—it’s a scheduled service—but it’s going to feel like that when they’re onboard. It’ll be pretty exclusive.

ET: With all the sales going on for premium cabins these days, if you sell me a ticket today for $2,000, am I going to be willing to pay $8,000 a year from now when things are better?

Simon Talling-Smith:I think that varies by customer. A lot of people who are picking up very good offers now are not people who have previously flown in business class very often. They wouldn’t normally think of it, but the price now made them try us. That’s good for us because it brings new people into that market. Will those people remain in the market when the prices change again in the future? I think we’re pretty confident. With products and assets, like aircraft and business class seats, you’ve got to take a medium view over the cycle. I think our view is we’re still confident that the basis of global business travel will come back again. We are in a tough period. But the basic globalization of the world economy is going to increase. That’s a steady upward trend. That brings with it business travel and business travelers want to arrive ready to do business and in good shape, want to have a good seat, want to sleep in a bed. I think companies will come back. Will it come back looking exactly like it did last year? I don’t know, but probably not. But it will come back.

ET: Could you give us a little bit of an update on your anti-trust filing with American Airlines and Iberia?

Simon Talling-Smith:We’re going to form a joint business between the three airlines across the Atlantic. The revenue sharing business is an $8 billion business. It’s big. We will work together for those groups across the Atlantic, and we will try to coordinate our schedules together so that we can offer better schedules. Then we will start more code sharing and also offer frequent flyer reciprocity. So you’ll be able to earn and burn BA and AA and Iberia across the Atlantic.

ET: If I’m a corporate customer, what’s it going to mean to me?

Simon Talling-Smith:What you’re going to see is the ability to get a proper joint deal with the three airlines. So instead of three account managers all coming in on seven days of the week and not bringing you the best price they possibly can, we can get together and come in, one of us or three of us, and understand your corporate business. So we can make you a very compelling offer spread across all of the carriers that serves all of your needs.

ET: Will there be a single sales force?

Simon Talling-Smith:No, I think that’ll probably evolve. Our intention to start with is to maintain sales forces for all three and have a much higher degree of coordination and cooperation. Over time, you can imagine us trying to get in a situation where there is representation going on. I think it’d be quite a long time before we only have one sales force.

ET: What about route rationalization?

Simon Talling-Smith:You’ve got situations right now where you have at least one BA aircraft and an AA aircraft taking off within 20 minutes of each other and going to the same place. That’s not totally helpful for the customers. So we have two choices then. The first choice is we could just split them across the day and give you a sort of three-hour gap in the schedule, thereby giving you more choice of when you fly. The other thing we could do is only have one flight because we don’t need two aircraft on that route. So we’ll put one aircraft on the route and then the other aircraft could open up a new route that currently nobody’s serving. So I would see this as an opportunity to offer better and different schedules.

ET: We’re coming up on about a year from the opening of Terminal 5. Could you give an update on where things stand and any business lessons learned?

Simon Talling-Smith:We opened Terminal 5 at the end of March last year, and it’s no secret that it was a very difficult opening—it was pretty much disastrous. But it was limited to a few days and then it began working properly. Our plan to transition normal flights should probably have been spread out. Looking back on that, what lessons did I learn? Well the obvious lesson is to make sure you are really, really prepared. I guess we should have sold the experience and the product a bit less beforehand—less publicity before and more after when it’s working. That sounds kind of obvious, but we did hype it quite a lot before. We just marched ourselves to the top of the mountain.

The other thing we would probably do next time is to do a much smaller day one launch, almost like a soft opening of a hotel, and really only have a few flights in there. I was working in the terminal, and I was struck that there were literally thousands, two or three thousand people, working in that terminal. It didn’t matter whether you were a baggage loader or a check-in agent or in the shops—everybody was a bit lost. It didn’t matter what kind of induction they’d had. Having an induction in a hard hat is not the same as being in the building. People were asking very basic questions—where’s the restroom, where do I get out?

It was the first time the building was operational. Many of us had been in the building while it was being built, but that’s kind of different. So I guess my sense was, given that people were really just finding their feet, which was completely understandable, probably next time we’d start out with fewer flights to cope with.

ET: I guess one of the things, if you’re a person running any business of any scale, is how do you know you’re not ready? I’m sure the day before day one you didn’t go into it thinking, this is going to be a disaster.

Simon Talling-Smith:Well, we were running some pretty sophisticated risk-assessment. What you have with risk-assessment is you have the likelihood of a risk and the impact of a risk. And we had a number of medium-likely risks.

What probably caused the biggest problem was not just the number of medium-likely risks that actually materialized, but the order in which they materialized. So there were one or two things that went wrong very early and that caused some early problems that just washed through the rest of the day. The lesson that we don’t often talk about is actually having the courage of your convictions. We put a lot of work into Terminal 5—planning it, investing in it, making sure the processes worked. It turned out to be exactly right. Once it was working within a week or so, we saw some great performances. It just got better and better throughout the year.

So, actually, although the opening day was disastrous, early on in the first season in the terminal, we saw better performance than we’ve ever seen, better baggage rates than we’ve ever seen. The speed of people getting through the terminal is really fast. You come in and check your bags and they’ll pretty much always be on the carousel before you get there. It’s a nice-feeling experience. When you go there, there are good quality shops, good quality places to eat, and it always feels sort of quiet and airy. And, yet, we’re running one of the biggest operations on earth in that building. In a typical year there will be 25 million people through it.

ET: How would you describe your management style?

Simon Talling-Smith:My strategy is normally to set pretty high goals and expectations of people and then to give them a lot of space to move about themselves. And that generally works out. I suppose there are risks, but I find it works.

I think partly because of the way the company is evolving, and partly because of the way society has evolved, managers are becoming less disconnected from the general population, and that’s good.

ET: You mentioned when you entered British Airways in 1991, that that was the heyday of Lord King and Lord Marshall, two of Britain’s most regarded business leaders.

Simon Talling-Smith:That’s right. Colin Marshall was Chief Executive when I joined and Lord King was the Chairman. I’ve seen Marshall, Ayling, Marshall again for a brief period, Eddington and now Willie Walsh is Chief Executive. So I’ve been through pretty different styles of leadership.

ET: Anything in particular from Marshall or King that as a young manager you took away?

Simon Talling-Smith:They were iconic. I didn’t know them well enough to really see them close-up, but they did really heavy-lifting in BA and literally turned the company around. But that was pretty much done by ’91. And, in fact, Marshall was preparing to hand it over to Ayling, and we were going in a different direction. But the work they did on getting people lined up around the customers and running a profitable business, after being a loss-making government institution, was amazing. It will be interesting to see which bits of BA’s history become business-case-worthy. They went through difficult times and what we’re going into now is probably the hardest time financially since then, in three decades.

ET: Anything else you’d like to talk about or add?

Simon Talling-Smith:This is a very exciting time for BA. When I’m talking to my managers I describe it as survive and fight time, and we have to survive. It is not to take for granted that any airline can survive this. We think we can if we do the right things. We also think that we can thrive out of it and become a real leader in the global industry. I think that means sticking to what we are really good at. We are good at service. We do have good products, but we can’t get complacent about them and let them go. We have to keep investing in our product, and that means that they’ve got to get very tough in the rest of the business. BA has got a good reputation of getting right through these tough changes.