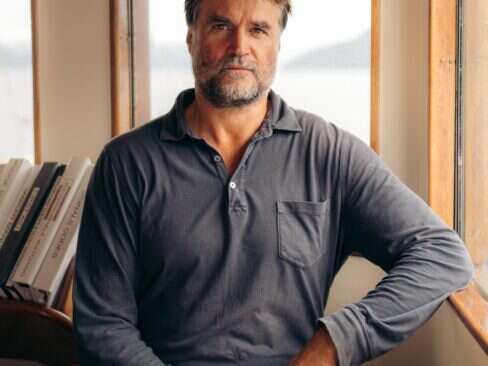

Debonair Swede Karl Wellner has turned Papamarkou into a highly regarded wealth management firm for the elite. Recently Elite Traveler President & Editor-in-Chief Douglas Gollan sat down with Wellner in his New York headquarters to get his fix on where the economy is going, how to stay rich, how to bring children into a family business, as well as his recommendations for great places for elite travelers to visit.

ET: So if we could just start, maybe for our readers who aren’t familiar with Papamarkou, give us a little bit of an overview of what the company is, the history and how you became involved with it.

Karl Wellner: We are a wealth management firm, 27 years old. Half of our client base is non-U.S., half is U.S., wealthy individuals and families. We are SEC-registered investment advisors. We don’t have any products to sell—we purely advise our clients on the best investment managers and products out there in the marketplace globally.

ET: And why don’t you tell us a little bit about your history at the firm?

Karl Wellner: I joined the firm in 2003. The founder, Alexander Papamarkou, had passed away and there was a period of turmoil. I stepped in and since acquired the firm about a year and a half ago. I grew up in Stockholm, Sweden. My background has always been in investment. I’ve been with a number of private banks and invested on my own, and then I joined this firm.

ET: So obviously, we live in interesting times. Tell us a little bit about how you and the firm are looking at the times we’re going through right now.

Karl Wellner: Well, I think more now than ever advice is needed, because there is real turmoil out there. We’ve gone through probably the most difficult financial period in history. And although there are some positive signs out there, there are many different types of signs, and I think more than ever people need to be ushered through the process. The opportunities out there are enormous, and I think anyone is well-guided by taking advice from professionals. All we do, all day long, is survey and monitor the markets and see what’s out there, and we only select the top, the best of the best of managers. So anyone is well-advised to use advisors like us at this point.

ET: As you know, even a lot of the wealthy have taken a hit over the last couple years or year and a half, but certainly some of them feel like the advice they were getting wasn’t that great. Is that an issue when you’re talking to new clients and prospective clients who may have been burned or may have had bad experiences with previous advisors? What do you tell these people?

Karl Wellner: Well no one really predicted what happened correctly, and I think that investors understand that what we do is really try to give neutral, independent advice that is as wise as possible and what we think really is the best. The wealthy individuals and investors really understand that markets go down and come up again, and they have been surprisingly calm throughout all this. I think that people have gotten hurt, but usually in bad times there are opportunities. The great wealths are created when times have been really difficult.

ET: What would be some of the opportunities that maybe you could allude to or talk about, at least from a macro level?

Karl Wellner: Well, across the asset classes you have, for instance in the real estate market, tremendous opportunities to be made; it depends on where you are geographically, both residential and commercial. There are great companies that have been beaten down tremendously, and if you look over a longer period of time, these franchises are sustainable, and it’s a good time to step in.

It certainly is not wise to be out of the market, which we have seen since March. The S&P 500 Index is up over 45 percent since March. If you would have taken your money out, it would have just sat on the sidelines. You would have lost out of this run-up. So to be invested is one very important thing.

There are great opportunities also on the distressed side. You have all these programs taking place; banks need to unload debt. It’s a great time to step in if you do it wisely and particularly do it with people who understand and who know others you can link up with.

ET: Since we’re talking a little bit about customers, what would be the profile of one of your customers or prospective customers?

Karl Wellner: Very wealthy individuals, families. We have clients who are in the ten-million-and-up range, and we have clients who have several hundred million dollars in investable assets. We really cover the gamut. We don’t like to say minimum levels for our clients. It depends, and usually it’s a relationship that grows over time. We also think multigenerational, so you may have a very wealthy patriarch who has children or grandchildren who start off quite modestly.

ET: Now, dealing with extremely wealthy individuals and families, does your involvement ever go beyond just financial advice to sort of an armchair psychologist or helping with other family issues?

Karl Wellner: Very much so. Since we do not sell any products, we really become the trusted consigliere. You know, we are like the family lawyer or the family doctor. You become extremely close to your clients. In many cases, they are or become your friends. You spend time with them and their families, and the more time you spend with them, the better you understand the issues. You travel with them and stay with them in their homes, so it’s a very close, close relationship. We’re not in it for a quick fix. We’re in it for a long-term relationship.

ET: How do you meet most of your new, prospective clients? How do they typically come to you?

Karl Wellner: It’s all word of mouth. We don’t advertise so it’s really referrals. People who feel that they’ve been well taken care of recommend us to their friends. And, you know, it happens when you sit next to someone at a dinner party. Conversation about finance always comes up, particularly these days, and you may say something that may trigger interest, and then you get a phone call.

ET: I’m just sort of curious, in terms of wooing new clients, I imagine people don’t meet you at a dinner and then the next day they hand you a big chunk of millions of dollars. What’s the typical cycle in terms of from the time you meet somebody to the time that they actually come and invest through you?

Karl Wellner: As I mentioned before, it’s about a relationship. The client has to feel that we can add value. I have to feel that we can add value to the client as well. So it’s pretty much trying to get to know you in the beginning.

Like I said we’re not in it for the quick fix. There has to be a comfort level; a trust level has to be established first. Some people have an immediate need, but in most cases, people are already taken care of elsewhere. But they may not be happy with the relationship they have, and they’re looking for something that is a better fit.

ET: How many clients and dollar assets are under management?

Karl Wellner: We have about 120 client relationships and several billion dollars of assets that we advise on.

ET: And the 120 clients would be 120 families?

Karl Wellner: Families or individuals, yes, correct. We don’t have institutional clients, really. But there are individuals and families that are the size of institutions.

ET: Maybe talk a little bit about your clients. Do they come from a specific demographic? Is it a real mix?

Karl Wellner: We have a real mix. We have clients who are extremely sophisticated financially, and we have clients who really are beginners when it comes to understanding finances, because they may never have been involved. It runs the gamut. As for demographics, we have old families with inherited wealth and we have entrepreneurs who have started from scratch. We have octogenarians who are clients, but we also have people who’ve made money through Google. They’ve been involved entrepreneurs from the get-go and have ended up with a fortune of several hundred million dollars. The issues and the problems, however, are the same. They know how to run their business, they know how to be entrepreneurs, but when it comes to taking care of their nest egg, the issues are very much the same.

ET: Switching gears a little bit, I know you’ve traveled the world and are a bit of a globetrotter. Why don’t you share some of the recent places you’ve been, and also just thinking about our readers like you, any places that you’ve been that you would recommend to a friend or recommend to our readers?

Karl Wellner: Well, I often go to Europe because many of our clients are in Europe. London is a frequent spot. There are great hotels in London, great restaurants in London. My last trip to Europe, I actually went to Istanbul, which was a highlight of the trip. It’s a very interesting city if you haven’t been there, and there are some tremendous hotels. And I’m actually going to mention one by name, which is Four Seasons Hotel Istanbul at the Bosphorus. It is an unbelievable hotel, and the service is absolutely top-rate. I was extremely impressed.

ET: Just in your travels, any other favorite hotels that you’ve stayed?

Karl Wellner: I love Claridge’s. I think Claridge’s in London is one of the best hotels in the world. And of course, in Monaco Hotel Le Paris is one of the old-world hotels that never fails in their level of service.

ET: Outside of work and your travels for business, any hobbies or things that you like to do?

Karl Wellner: I love sports. Skiing is a big passion of mine but I must say the older I get, the more warm weather and sand and summer are enjoyable. So I also like tennis and swimming and golf.

ET: Any resort recommendations?

Karl Wellner: In the Caribbean, obviously there are many nice places. There’s also been a lot of transition in the Caribbean. Some hotels that were great with golf courses have had to close down due to the difficult economy. I’m a fan of St. Barths. I think it’s a terrific island. I hope they keep it that way, because it is the way St. Tropez was 30, 40 years ago with small buildings and smaller hotels, and it just has this special ambience.

ET: What about skiing? Any particular mountains for avid skiers?

Karl Wellner: I’m a European, so I love skiing in Europe because you have the combination of food and service and skiing. St. Moritz is a top place. So are Zermatt and Gstaad. Also Colorado is fantastic and Canada is really good.

ET: I’m just curious, do you have children?

Karl Wellner: Three kids.

ET: And are any of them involved in the business?

Karl Wellner: They’re too young yet, but we’ll see.

ET: How old are they?

Karl Wellner: The oldest is 18, so 18, 14 and 12.

ET: This is now a family business so would you like to see them get involved?

Karl Wellner: Absolutely, but only if they’re interested and if they have the right character traits for it. It really is a personal business and you have to understand the way to deal with both the financial aspect of things and also understand and like people, because you really have to try and get into someone else’s skin and try to understand what their issues or problems are.

ET: So as I mentioned, a lot of our readers own or control their own businesses, and certainly you see with your clients both families that have been successful bringing in other family members and families that have had challenges. So what would be your recommendations, having probably seen the best and worst? If you have children who might be interested in the business, some people say send them outside for a few years but some people want to bring them into the mailroom.

Karl Wellner: No, I think it’s very important to get as broad an exposure as possible out there. You can always come to the family firm and work later, but try to get a great education—number one—then get as much experience as you can during your education time and then come into the family business, but only if you really want to come into the family business and if you feel that this is passionately what you want to do. Then you’ll be successful. If you’re not passionate about something, you may as well do something else.

ET: Well, the other side of the family business is your wife, Deborah Norville, who is in television and media. So any of the kids interested in getting into that side of the business?

Karl Wellner: They get exposure to both businesses, so they’re going to be the ones who will have to pick down the road. We’ll just help to usher them. At the end of the day, it’s up to them.

ET: So you mentioned you’re Swedish. Do you still go back to Sweden?

Karl Wellner: Oh, absolutely. I was there just a couple weeks ago.

ET: And are you a sailor at all?

Karl Wellner: I am. I actually took my daughter to sailing camp in Sweden.

ET: And do you have a boat?

Karl Wellner: I did. I don’t have it right now. You know, it takes a lot of time.

ET: A sailboat?

Karl Wellner: I had a sailboat in Sweden, but I didn’t go often enough to merit keeping it there. There are some fantastic boats out there, and if you go to Italy and Sardinia in particular, there are some great races and fantastic boats to see.

ET: I was just going to ask, for any of our readers that are sailors, the archipelago is beautiful in the summer. Any itinerary recommendations or places they should go?

Karl Wellner: Well, Stockholm is a fantastic city if you haven’t visited it, and outside Stockholm there are 24,000 islands. So there’s plenty of sailing waters. It’s very difficult because you have to really be careful not to hit any underwater rocks. But a nice route from Stockholm over to Helsinki and then St. Petersburg is fascinating.

ET: So back to business, just thinking about the types of issues you’re hearing when you’re talking to your clients, what are the things that are keeping them up at night these days?

Karl Wellner: Well, of course you know, when we really had the worst moments in this meltdown, people were worried about the stability of the financial institutions. They were very worried about their money being safe. That has sort of disappeared now. People are wondering how much more they should step in with.

Diversification is always on people’s mind, or on my mind more than anyone else’s maybe. There are always concerns, but I think that as time passes after crises, these concerns become more normal—what do I need as far as liquidity is concerned, the generational shift issues that are more traditional, etc.

ET: I think Tim Geithner was on one of the news shows yesterday saying that unemployment may not top off until sometime next year. Putting your forecasting hat on, where do you see us being right now in the recession? And then also maybe talk a little bit about the U.S. versus the global economy?

Karl Wellner: Well to start with the unemployment question, although the U.S. may have an unemployment level just short of ten percent at this point, it’s still tame compared to Europe. They have always been used to having far higher unemployment, and the countries that report lower unemployment may have hidden employment because the government programs take care of a lot of that. That’s number one.

Americans are also far more flexible than most Europeans when it comes to moving from one location to another to get a job. It’s very hard to get a European to move from one city to another, but it’s not unusual for a New Yorker to move to Chicago or California or somewhere else where there are opportunities.

I think that we have seen the worst. I don’t think we’re going to test the lows of the markets again. There will still be some effects going forward. There are some areas geographically that are far harder-hit than others. But I think we have come through it, and the market is usually six to nine months earlier than the change in the whole economy.

Some European countries are doing okay, some less so. The emerging markets are certainly interesting areas to look at—maybe Eastern Europe or Brazil. If you look at China as an example, they have a GDP growth of eight percent without even worrying about exporting to other nations—just by their own internal demand. So I think China is a story that is here to stay and will be far stronger going forward.

ET: Another question I have is sometimes you hear these sad stories about people who have had some type of enormous success in their business and somehow came upon a large amount of money and then within a relatively short period—and you see it sometimes with athletes and entertainers—the money is all gone.

Karl Wellner: Absolutely, yeah.

ET: So for people who have been fortunate enough to have a great success but are new to being super-wealthy, what type of advice would you give to those people?

Karl Wellner: I think it’s extremely important to express to someone who comes into great wealth the importance of getting advisors that you can trust. There are a lot of hangers-on who will want to help, and we’ve seen many stories of those advisors abusing the role. But it’s important to go out and interview a number of people who are neutral and really try to get the best advice. It’s not easy to have great wealth, to know how to handle it and to continue with that wealth to the next generation. It’s easy to misspend or invest unwisely. You need professionals in any business, and it’s the same thing on the investment side.

ET: So is there anything else that you’d like to talk about or mention?

Karl Wellner: I think that it’s important not to stop living and spending, and I think that that helps all of us. I think that you’ve got to be sensible; you’ve got to spend what you have. Yes, we live in an economy where you do borrow money and you live on leverage, but don’t overextend. Have the money before you spend it. And whatever you do, buy quality, think quality. These are always the things that last.