The demand for private aircraft has been surging with wealth creation in the markets and Covid-19.

Indeed, demand has increased even from last summer, when we reported that “private aviation had reached all-time highs,” and we have been inundated with calls from clients asking about their best options to own and fly privately.

Our best advice: It’s more important now than ever to be an informed aviation consumer. Be sure to know your ownership options, the realities of the current market, what tax deductions there may (or may not) be, and how your desire to own a plane meshes with your other financial goals.

Know what type of buyer you are

First, what form of ownership interests you? To help review your choices, we offer a brief primer.

If you think you might like to own the plane by yourself, we suggest pinpointing your reasons. Knowing your “why” will help you to assign an economic value to the goal of airplane ownership. It’s also wise to be clear about just how motivated you are, so you can better weigh this goal against the costs of a plane in light of your other financial priorities.

So, do you want to own a plane primarily because you:

- Want to use your time more efficiently? By far the biggest benefit of private aviation and the reason most people opt to own their own planes is that it saves time and effort. For example, in one day, an executive could fly to meetings in three different cities and still be home for dinner that evening—a feat that likely would be impossible with commercial air travel.

- Have a passion for airplanes? A small number of plane buyers are like car, horse and yacht enthusiasts. They’ve loved aviation since childhood and want to get involved not only in owning, but also running (and potentially even flying) their aircraft.

- Are interested in the experience? Covid-19 has dramatically increased the number of people interested in private aviation because flying alone is inherently safer, health-wise. Also, flying private through providers that have brand affiliations can provide unique access to “money can’t buy” experiences and events. But, do note: To enjoy these benefits, it is often unnecessary to take on the full burden of owning and running an aircraft. If you are this kind of buyer, charters or fractional ownership may be your better choices.

Demand for aircraft is high, so inventory is very low

After “know thyself,” comes “know the market,” and we cannot stress the unusual nature of today’s market: There is a limited supply, higher prices and significantly longer wait times for new planes.

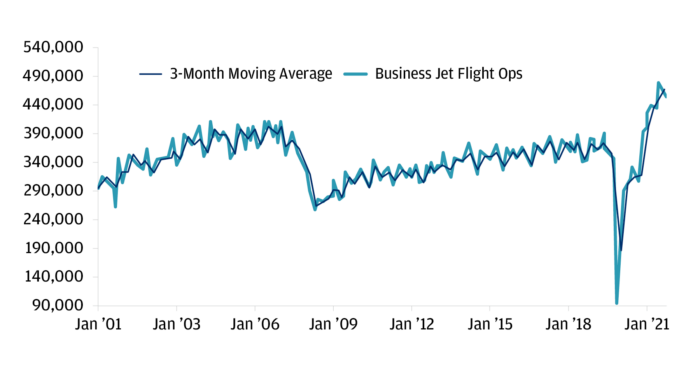

The reasons are clear: Demand for private aviation stayed consistently high through 2021. US business jet flight activity was up 27% in November 2021 over November 2019’s pre-pandemic levels 1. The increase was largely in shared aircraft usage, with charter and fractional up 32% and 41%, respectively.

So far, the major business jet manufacturers have been prioritizing growing their backlogs. They refuse to commit to increasing production, due to lessons learned from previous cycles in which demand spikes led to oversupply.

The demand for private aviation is now at record highs

Business jet flight activity: Total US monthly flight operations

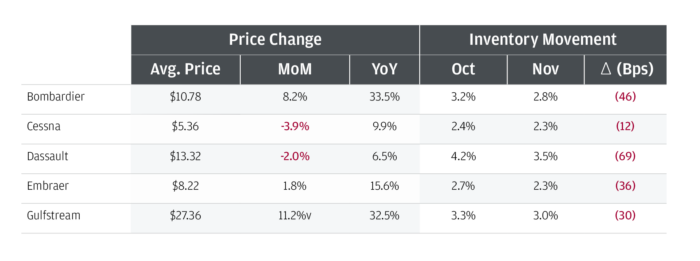

Bottom line: As the chart below shows, asking prices for used airplanes have gone up 6% to as much as 33% due to this higher flight activity, Covid-19 concerns, limited inventory and lack of supply from manufacturers. And wait times are now running anywhere from nine to 24 months for new planes.

Used planes are more expensive now

Average used jet asking prices by company

Purchasing and operating a plane are always costly propositions. However, given that they are particularly expensive now, we’re emphasizing to our clients the need to engage in a thoughtful process.

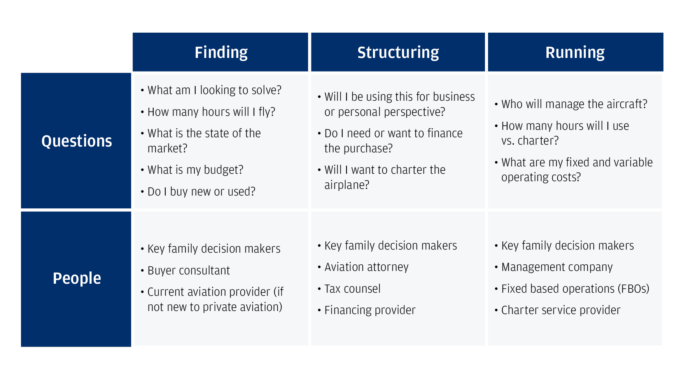

Buying an aircraft is a process

Our advice is always that clients recognize they’re not making a single decision (i.e., to buy a plane). Typically, they are making as many as three decisions: finding the right plane, structuring the purchase and running that plane.

To make decisions that best suit your needs always requires thought and consultation with the right people. It’s wise to get input from your family decision makers as well as a broker/consultant, aviation attorney, accountant, financing provider and charter/management company.

Many of our clients ask trusted family members or leaders in their family offices to handle this process—which, given current market conditions, can now take two to three months of nearly full-time attention. They’ll need to identify the right aircraft, structure the acquisition to suit the family’s goals, and hire the right partner to run the aircraft day-to-day.

When buying a plane, ask yourself the right questions and speak to the right people

Look carefully at potential tax benefits (or lack thereof)

It is particularly important that you consult with your tax advisor.

We generally recommend against making any move solely for tax purposes. That is as true for airplane buying as it is for any other major purchases, investing, charitable giving and other financial decisions.

You’ll also want to be careful not to assume that tax benefits will help defray all your costs of buying and owning a plane. And, if you are a business principal and think that a plane will help you shelter business as well as other sources of income, think again (particularly if business use is not the sole or predominant purpose of the aircraft).

Yes, there are potential tax advantages (bonus depreciation, interest expense deductibility) if you use an airplane primarily for business purposes, and if those business purposes are well supported and documented scrupulously.

There can be potential limitations to those tax deductions if you or related parties use a business plane for personal flights to any significant degree. Business entertainment as a flight’s primary purpose no longer qualifies as business use. And the rules on leasing to third parties are complex.

Also note that starting in 2023, the bonus depreciation benefits will gradually shrink by 20% each year2, until they disappear entirely after 2026. Moreover, the sunsetting of the depreciation tax break starting next year seems to be adding fuel to the current, already outsized demand to buy a plane soon.

J.P. Morgan Private Bank can help

No one knows when the market for private aircraft will cool off. Many hope that inventory levels will rise as the pandemic eases and corporate executive travel increases. Then, large corporations may resume their plans to refresh their fleets. Companies may even decide to downsize their fleets due to changes in business travel trends (Zoom instead of vroom).

If you are thinking about buying a private jet, ask our J.P. Morgan team for help in thinking through this important purchase. We can help you understand how airplane ownership might impact any of the other goals you have for your wealth. And if you decide to go ahead, we can help you make sure your liquidity and lifestyle buckets are funded and invested to support this goal.