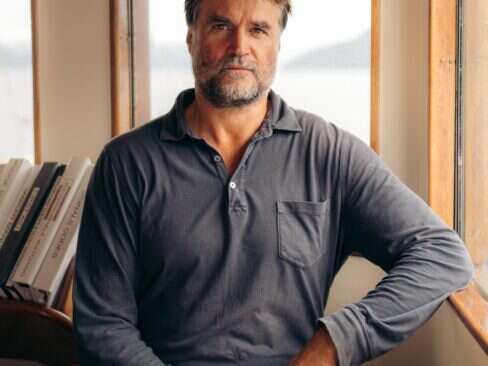

Founder, Chairman and CEOCIRCA

Chris Del Gatto has successfully turned buying and selling second-hand jewelry into a luxury experience. A veteran of the diamond trade, the polo playing Founder, Chairman and CEO of CIRCA is showing his knack for branding and customer service is as great as for stones. Recently Elite Traveler President and Editor-in-Chief Douglas Gollan caught up with Del Gatto at his New York headquarters to find out his plans for the future and how the current market is affecting them.

ET: Why don’t we start by talking a little bit about your background, how you got into this business and a little bit about your own personal history?

Chris Del Gatto: I actually started right out of high school. When I was 17 years old, I studied at the Gemological Institute of America, which is the only school that gives you the accreditation to become a graduate gemologist. So I don’t come from a family within the jewelry industry, which in and of itself, is unique. The industry is very dynastic and very much closed to the outsider.

So I studied to become a gemologist and worked as an appraiser in the diamond district here in New York on 47th Street for about a year. Then I was very interested in diamonds and diamond cutting, so I apprenticed to be a diamond cutter when I was 18 years old.

I apprenticed with an old-line diamond manufacturing firm on 47th Street, ultimately working myself up to becoming a partner in that firm, and I helped grow the firm to the point where we were about four or five times the size as when we started. I sold my interest in that firm when I was about 22 or 23 years old, because I saw the diamond market changing dramatically, and I thought a lot of the mid-market players would be squeezed out of the pipeline of supply, which is what happened.

I saw what was happening in the diamond market, but more importantly, the inefficiency of the estate jewelry market. It was kind of a Wild West atmosphere where people didn’t know how or where to get product. It was the polar opposite of the diamond market, which was controlled from the ground by De Beers, especially at that point in time. They controlled about 80-plus percent of the world’s market in rough diamonds; and they sold it through their site-holders, the De Beers site-holders, so there was a very defined channel.

So I took that model and thought about who’s at the source of secondary diamonds and jewelry. Not the diamonds that you pull out of the ground, but all the stuff that’s been worn and bought and worn again over the years that is out there waiting to come back into the market. Looking into that model or that business further, I recognized that there really wasn’t a luxury brand. There wasn’t a company doing it in the right way, in a corporate way, a transparent way, an upscale way, and offering the general public basically a liquid market for their diamonds, jewelry and watches anywhere. That just didn’t exist. That was really a big light bulb moment for me.

ET: About what year was this?

Chris Del Gatto: 1996-97. During this time I was getting experience in the estate jewelry business. Since I sold my business, I was able to start buying and selling estate jewelry. I traveled around the world and I bought at auctions; I bought in London, in St. Moritz, in Geneva.

Just from being in the diamond industry, I knew a lot of the big estate jewelry dealers already so I was able to get into the jet stream of the people who were doing the deals and buying at auction, and I started to pay for my education by making mistakes. Obviously I had a very good diamond education, so that was never a problem, but buying estate jewelry was a learning experience. It was a valuable experience, traveling around the world buying and selling.

It was really at that point when I recognized that everybody used to talk about how good it was when they were able to buy something that was “fresh,” something that had been sitting in a box for 10 or 20 years and they either bought it directly from that private because they were referred to that private, or they bought it from a retail jewelry store representing that private, which was, at that time, more often the way it happened.

So recognizing that there was 50 billion dollars a year of retail jewelry sold in North America alone, what percentage of that is sold back to the trade that same year, for whatever reason? Relationships break up, remorse, they don’t like the item, fashion changes, the tastes change, monetary reasons—it’s got to be a big number. Even if it’s five percent, that’s a huge number. If it’s two percent, it’s still a big number. But what about the items that were sold the year before and the year before, and going back 20 or 30 years or longer, things that are in a box for 100 years? How could there not have been a proper brand specializing solely in satisfying this need?

So there’s obviously this huge market. There, to me, was not a very satisfactory solution for people who wanted to sell their jewelry. You had on one end pawn shops, which most clients wouldn’t go to. I wasn’t looking to attack the cash-for-gold market, the people who were selling broken chains to pay their rent because they lost their job, but people who had resources, not necessarily wealthy people, although that’s certainly an important part of the customer base, but just regular people who had jewelry they no longer wanted.

So that was the initial idea, and I launched the company in 2001. At the time, we launched under the name of Sell Jewelry. We had our first office here in New York City, and we started to advertise to the general public. The second office was in Chicago, about a year later. Then about two years after that we changed the name to CIRCA, just because Sell Jewelry was a little bit, we found, down-market for the service that we provided.

And, talking about down-market or up-market, we recognized from the very beginning that we not only had to do a great job in providing this service, but we had to change the public’s perception about what it meant to sell a piece of jewelry. There was never a proper company or a brand doing this and only this; it was always looked at as distasteful. Or if you were selling your jewelry, it must mean you needed the money, unless you had sold at Sotheby’s or Christie’s, which is a very different kind of process altogether because it’s an auction and very expensive. So our marketing from the beginning was very upscale and sophisticated, and very open and transparent, with the idea that it’s not right to have this non-performing asset sitting in a box. The savvy consumer is a savvy seller if she doesn’t wear an item any longer.

So we worked very hard, and from 2001 to now, there really is a very different perception about what it means to sell something, and it’s largely due to CIRCA’s print advertising and now television campaign, elevating what it means to sell your jewelry.

ET: Just from seeing the advertising, certainly it appears that you’re trying to position CIRCA as a luxury brand.

Chris Del Gatto: There’s absolutely no question that CIRCA has become a luxury brand in the jewelry industry. However, technically what we do is provide a premium service. We’re what has been coined as “reverse retail;” as I said, we’re not selling to the public. We’re buying from the public. But again, we don’t only deal with the wealthy, although some of our clients are some of the wealthiest people in the world. But when people want, for whatever reason, to sell jewelry, it should be a pleasant experience.

The fact of the matter is this is a crucial service that needs to be provided by specialists. We sit in front of people and make very significant offers, looking at 19th-century jewelry and a ten-carat diamond and an old watch, and you’ve got to have the knowledge to say, “Mrs. Smith, we’re going to write you a check now for 84,000 dollars,” and know that that’s going to be an offer that no one else can beat. So there’s a real skill set that is hard to attain. And that’s a very big difference between us and the other buyers that you see out there who are strictly gold buyers. We understand the true value, the value of that piece of jewelry, not just the gold. We bring a different level of expertise to it.

ET: So now let’s assume somebody reads this and they’re interested in selling some estate jewelry. How does it work? Walk me through the process for a potential customer.

Chris Del Gatto: There are basically three ways that you can interact with CIRCA. We have offices around the country—in New York, Chicago, San Francisco, Palm Beach, Washington, D.C. We also have an office in Hong Kong. You can call and make an appointment to go into any one of those offices, and the way it goes is you sit down with the buyer in a lovely surrounding, they’ll evaluate your jewelry right in front of you, they will then make you an offer in that same visit, and cut you a check if you accept that offer immediately. That’s one way.

The second way, which happens all the time for people who can’t get into one of our offices, is they will mail the jewelry to us. If the items have a larger value, we’ll send out armored car pick-up—and we pay for it—all over the country to pick up the items; and it comes back to the CIRCA corporate headquarters here in New York. The buyer then calls the client and makes an offer. If the offer is accepted, either a wire transfer or a check is sent.

The third way is we have a network of some of the most high-end independent retail jewelers in the United States that work in conjunction with us, and they’re called “CIRCA Purchasing Agents.” These are truly the best retail jewelry stores in their given areas. They carry Rolex and Patek Philippe and David Yurman and all the better names in jewelry, and they act as our agent. Clients can go into that store, drop off the item or items and receive a CIRCA receipt. Then the item is overnighted to CIRCA NY. From there the process is the same, in that the buyer will call you, make an offer, and, if the offer is accepted, we overnight a check back to that store for the client to pick up.

So that gives us extended reach by having these satellite retailers, even though we’re opening new offices every year. It’s added credibility for us and for that retailer in that area that we’re working with.

ET: Just here at your headquarters in New York, as I was looking around, I saw some—what would you call them—appointment rooms or private salons?

Chris Del Gatto: We call them buying rooms.

ET: The buying rooms, they felt like luxury boutiques. The same type of private salon—is that on purpose? Is that the same throughout your other locations?

Chris Del Gatto: Yes, all of our offices look almost the same, with maybe one exception. Again, we’re providing a luxury service. And we’re often buying—even if it’s a one-carat diamond—an important gem to the person selling it. The environment and the buyer should reflect that. The client should be comfortable. The offices are beautiful, and all of our buyers look and are trained a certain way to deal with clients; customer service for me is the number one priority.

So the experience should be a good one because it’s often an emotional process for people to sell something that they’ve had maybe for many years, or is representative of a spouse who’s no longer with them or a past relationship. So we’re very cognizant of all that.

ET: Just the other day, in Advertising Age, there was an article talking about your company and how barter is becoming important in a time where a lot of companies across the whole spectrum are sort of cash-poor but still have to buy advertising. So why don’t you talk a little bit about CIRCA’s business, broadly? You buy jewelry, but what are some of the other things that you guys do?

Chris Del Gatto: Everything that we’ve described to this point is what we call our core business. CIRCA’s DNA, and what we’re most known for, is a brand that buys jewelry from the general public. But as our name and reputation has grown, the industry has come to us as well. The newest businesses that have really been, in a sense, helped by the situation in the economy are the wholesale divisions.

The wholesale divisions basically do the same thing with the trade that we do for the general public. We write checks for jewelry, and we pay higher prices than anyone else out there. So we work with many major watch and jewelry brands when they have excess inventories, especially right now as sales are not so great.

You referred to barter earlier; I was exposed to the barter business because some people in the barter business at the time who were dealing with jewelry companies would take jewelry for advertising, and they would come to us because the barter company isn’t an end-user for the jewelry. They don’t know what to do with it, and they didn’t know how to value it. So before they executed a deal, they’d say to us, “Hey, I’m doing a deal with XYZ jewelry company. How much value can I assign to this? And if we do the deal, would you buy it?”

So I thought why wouldn’t we bring this service in-house and actually be a barter company that is the end-user; it’s simply another way for us to pay that may be more appealing than money. Most barter companies do food deals and chemical deals, and they’ll do a jewelry deal once in a while. There’s a real need for watch and jewelry brands, to continuously advertise. Even in the best of times, all of those companies have excess inventory, and why should they write-down that inventory or take losses on that inventory if they could transfer it into advertising credits, which we have the ability to do for them.

So we bought a barter company that I was very familiar with and had done a number of deals with. Now, when we talk to major brands, we go to them and say, “Hey, we know you have excess inventory. You talked to us about trying to sell it. We can write a check, barter or do a combination of the two.” So oftentimes when we deal with these brands, we’re writing a check for part of it, and we’re taking another percentage of that inventory and giving them advertising credit.

ET: So you’re buying all this jewelry; who do you sell it to? Who are your customers for sales?

Chris Del Gatto: Many different platforms. In our core business—the core business being buying from the public where we basically buy one of an item—we have collectors from all over the world who are in our New York headquarters monthly. So we have collectors of Art Deco jewelry, collectors of large diamonds, collectors of watches. We have people who own businesses that need smaller, modern, gold jewelry, because they’re selling either to Eastern Europe or Asia or they’re selling on the Internet. So we’ve got buyers for every product category.

In the close-out business, where we’re buying maybe a thousand of one item, the dynamic is very different. We sell to many of the major off-price retailers—typically not jewelry retailers, but the off-price retailers that can swallow a lot of product quietly, that specialize in delivering what usually are name-branded watches and jewelry at discount prices. And we deal with high-end Internet sellers as well, although only a select few reputable ones. So we’ve got a really wide, varied platform for distribution.

ET: So just speaking about growth in the next three to five years, where do you see CIRCA expanding? Where do you see opportunities to grow?

Chris Del Gatto: We haven’t scratched the surface, really, in any of our businesses. Our core business is rapidly growing. Our core business took a hit in the economy, and people say, “How could it be? You’re a buying company. I would think when the economy fell apart people would be lining up.” But actually CIRCA dealt with clients who, when the economy fell apart, didn’t need their jewelry to pay their mortgage, they just stopped spending. But they had this jewelry that they weren’t using. They weren’t going to sell it and put that money in a bank. They were scared of banks. They were scared of putting money in the stock market.

Also, the perception was—and it was incorrect—that if they were selling when the economy was really bad, they were selling into a buyer’s market. Our price didn’t change. We still had tremendous global demand, all the way through. Now we see our customers coming back, and that core business is really coming back to almost where it was pre-recession. People are starting to act normally again, at least on the selling side.

We only have six offices in the United States, but we’ll probably have another six to ten offices within the next couple of years. We were launching in Europe before the recession hit, and I was about to hire a CEO, and our first office was going to be in Paris. So we’ll be in Geneva, Paris, Milan, etc. Our Hong Kong office was started with tremendous success; we’re getting it back online now. We’ll probably have another one or two offices in the Far East and in the Middle East.

With our wholesale businesses, they’re also very new. Eventually we may look at building our own internet retail platform, because there’s nobody who owns as much branded product as we do at the prices that we own it, and why wouldn’t we want to go somewhat vertical for a lot of that product, especially in the age of all these 24-hour and 36-hour internet sites that use us to supply them? And they’re doing very well. Why wouldn’t we want equity in something like that?

Our wholesale business, in partnering with all these major brands in the watch and jewelry sector, is just at its beginning phase. Most recently, we launched a division called CIRCA Capital, in which we’re giving collateralized loans to the industry only. So we’re evolving into a company that provides solutions, both to the general public and the trade when they’ve got jewelry as an asset.

ET: Before we started you mentioned you’re out the door to Sardinia after we’re done, so talk to us a little bit about when you’re not busy building CIRCA. What are some of your favorite things to do, places to visit?

Chris Del Gatto: I’m a divorced father of two, and even before my business, my first priority is my two children. I have a nine-year-old boy and a seven-year-old girl, and they’re absolutely the joys of my life. But I’m a workaholic, so I try to balance the work that I do and love—I love building businesses, and we’ve got so much potential here that it takes a lot of time. But my kids are my first priority, so as much time as I can spend with them, I do.

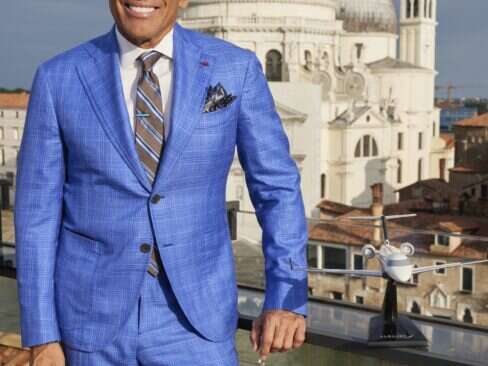

My other passion, true passion, is polo. I play in the summer in the Hamptons, and in the fall I go to Argentina for almost a month every year to play in professional tournaments there. The CIRCA team plays in Palm Beach over the winter as well.

It’s funny because I only started playing polo about four years ago and never thought it to have any kind of affinity with CIRCA. But the team I play on is the CIRCA team, and we’ve probably gotten more publicity about my polo playing than anything else we’ve done. The public responds to it. It’s very funny how the sport is looked at as something that is glamorous, and it’s got a very real connection with jewelry and the aesthetic world that CIRCA lives and deals in daily.

ET: Is the CIRCA team successful?

Chris Del Gatto: Absolutely. We’ve won tournaments in Palm Beach and in the Hamptons last summer, in Bridgehampton, CIRCA partnered with Ralph Lauren, so the team was Circa-Ralph Lauren Black Watch, and we got to the finals in two of our tournaments. So, absolutely, we’ve done well in a number of tournaments. It’s fantastic.

ET: Aside from polo, any other hobbies or passions?

Chris Del Gatto: I love music, I love movies and I love art. I think when you’re in the world of jewelry, if you’re attracted to it, it’s very much because you have an appreciation of beauty or have a strong aesthetic opinion. And fashion, I love fashion very, very much. At some point I could see us owning a fashion company, because it’s very much synergistic with a lot of what we do. But that’s way off in the future.

ET: Do you ever see CIRCA actually coming out with your own line of jewelry?

Chris Del Gatto: No, but we’re actually looking now at one or two amazing jewelry brands that I very much respect that are underperforming, and are ripe to be bought. If I were to own a brand under the CIRCA group, it would be an established brand that really has a skill set, a heritage and a history of doing something special in the production of jewelry and the design. But the CIRCA name I need to stand for being the best in the world at what we do—and that’s buying jewelry, and providing this really needed service both to the general public and to the trade. And I want that to be that.