Founder/ChairmanThe Luxury Marketing Council

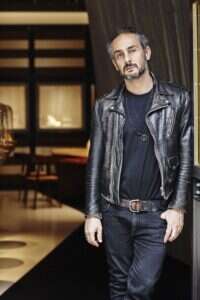

Greg Furman started his communications career as a policy advisor and speech writer, and went on to lead Sun Oil’s public affairs division, be managing director of advertising for the NYSE, head J. Walter Thompson’s corporate image PR business and operate Bergdorf Goodman’s various communications initiatives. In 1994 he branched out on his own to form The Luxury Marketing Council, a group of 1,600 CEOs and top marketing executives. Additionally, his strategy consulting practice focuses on helping his clients define their missions and corporate positioning. In February, Elite Traveler sat down with Furman in New York to discuss the new luxury message for the recessionary economy, how companies are changing the way they speak to wealthy clients, and his own passion for the arts.

ET: What is The Luxury Marketing Council is?

Greg Furman: The Luxury Marketing Council is my baby. After leaving Bergdorf Goodman where I ran the marketing and catalogue business when Burt Tansky, who is the now the chairman of Neiman Marcus, was chairman, I realized I couldn’t hold a job any longer. And I didn’t want to either. So I had this notion–this is the end of 1994–as I was looking to the door, having seen what I somewhat respectfully call a three-brand, arrogant industry groups, meaning–the oil industry, financial services, and, lastly, through the auspices of Bergdorf Goodman, luxury. And you know how some days you wake up and you say as you go into the soul searching, you say, “What was my experience all about?” And I thought, “What did I learn?” And I learned that I had in-depth experiences with three industry groups, all of whom were primarily driven by image advertising, and had not historically really thought about fully-integrated, strategic, classic packaged goods advertising in the way that you and I would know it from an agency perspective.

And having seen that, and having understood, I think had a good sense at Bergdorf of the market. I thought, “Wouldn’t it be interesting to put the CEOs and CMOs across every segment of retail: fine jewelry, travel, publishing, hoteliers, concierge services, apparel, restaurateurs, financial services, you name it, the people that truly understood the best customer. And then professional services: the ad agencies, the PR agencies, the design folks, and all that. Put them in the same room with one burning platform, help everybody get more money from the people with the most money.”

And so, at the end of ’94, and in the very early days of ’95, thanks to Sotheby’s and Dan Camp, who used to be the head of the Carlyle (he gave me the presidential suite), I invited in three separate meetings about 100 CMOs, CEOs, of maybe 30, 40 each, to present the concept. And the concept being: assemble the community of top people, decision-makers; help them all figure out ways to get a greater share of wallet with the best customer; become, if not the global thought leader on how the luxury market is changing and how the luxury customer is changing, certainly (A) a global thought leader, (B) an incubator, or a greenhouse, to force bloom partnerships and collaborations among members so that they’ll get smarter together as to who is doing the best and smartest things from a marketing standpoint. They’ll be inclined, having established good chemistry together, to share costs, to share database, to share insights into who is doing the smartest stuff, and then most importantly, collaborate and partner together to ultimately, I like to say, surprise and delight that very best customer.

So I started with about 32 companies at the very beginning of January ’95–Cartier, Dunhill, Montblanc, Swissair, Bergdorf Goodman, Neiman Marcus, and others. Mercedes-Benz, Rolls-Royce, Bentley, and now in year 15, the Council in New York has about 320 brands, about 2,000 CEOs and heads of marketing, and last year we did 40 events. Members host everything, and we just look at every aspect of the marketing mix and how the market is changing. So how’s the customer changing, how are people changing the way they market, what are the trends, what are the issues? So the content of our meetings is, as you know, authors, economists, panels of CEOs, luminaries of every stripe, futurists, design people, artists. And we provide a very robust forum for that type of discussion, and every time we gather, encourage people to work together.

So not only have we been fortunate in growing in New York, but I had this notion that one could license it. So now, I licensed the concept and have partners in 28 cities, worldwide. So we’re at about 680 brands andcompanies, probably just pushing 3,000 CEOs and heads of marketing, and I’m in contractual discussions now with at least seven or eight other cities. So by mid-year, even with the economy, I’m hoping that we’re going to be in 35 cities worldwide. And now we’re in Boston, New York, Atlanta, Ft. Lauderdale, Palm Beach, Sarasota, Tampa Bay, Austin, Houston, Dallas, Ft. Worth, L.A., Orange County, San Francisco, London, Dubai, Abu Dhabi, Rio-Sao Paulo, Mumbai, New Delhi. And it’s been great.

And I think the premise that holds more now than maybe any time in the history of the Council, was that if it works in good times, and has legs in good times, now is the time, in my humble opinion–and that’s been my opening of my letter to members this year–now is the time when the community that we built, and the relationships that we’ve established–and you and I are quintessential relationship players, so you know that story. Now is the time that we can capitalize on the investments and relationships that everybody has developed. So we’re really pushing this year to have people even invest more, not so much from the dollar standpoint, but from an involvement in the community standpoint, where I think there’s huge leverage because the aspirational market, the folks with household incomes of $250-$500K is gone, just gone. So now it’s people that still, even after the shakeout, have liquid portfolios of $10 million or more. And those are the ones, everybody thinks of them as their best customers. Those are the ones that if courted and engaged properly still have money to spend, but it’s a whole different ballgame, as you well know.

ET: A lot of people leading into the crisis thought that luxury was going to be somewhat immune. What happened?

Greg Furman: I think to your point, there was, and I include myself among them, up until probably I’d say mid-September, the luxury market was on a tear. As I know you know, like you have never seen in history. I mean, I would say the last 14 years, if you looked at mass retail, and looked at mass retail from the standpoint of revenue growth, mass retail, if it did 5 to 7 percent gross revenue growth, would do the happy dance. And if you looked at our constituents, the top brands that are courting your readership and my constituents, community buyers, those people were allowing these folks in the high-end luxury brands to grow at 15 to 32 percent gross revenue a year. And especially with the Bentley’s and the Louis Vuitton’s and the Hermes, and many of them have still not been restrained by this, as I know you know.

Having said that, once things started to spiral down, and the media frenzy of feeding the flames of the fire, and all of a sudden, luxury itself became a bad word. I had a discussion today with a woman from AdWeek who told me, and she wanted me to comment on an anecdote that she was told by a person of some repute in New York, that said when she shops in Hermes or Cartier, she went to the store, and she said she wants a different bag.

ET: Do you believe that?

Greg Furman: I think that’s extreme. And what I said to her, I said, “If you’re asking me about conspicuous consumption,” I said, “Conspicuous consumption among this elite cadre of consumers is long gone.” And with all respect to China and Japan, where the bigger the brand, the happier people are, you know. The joke at Mercedes is that the lower priced vehicles have the biggest medallions on the car top. So conspicuous consumption, and showing the brand, and displaying it, being ostentatious about consumer luxuries has been dead since the ’80s in the U.S. I think people are much more, I don’t think you can say “spiritual,” but much less concerned about display than they are about value and quality. So, in that sense, I think there’re always going to be people that are going to spend money. So the conspicuous consumption side of it to me is not an issue. But, for me, the issue in this market is I think everybody is feeling the pinch. And those that are awake at the switch–and we did a survey, which I can tell you about, in November, are completely reengineering their approach to spending across the ad mix.

It was a survey of about 4,000 individuals: CMOs, CEOs of luxury brands. And what we asked was, “How are you, as an organization, a luxury brand, from a marketing standpoint, re-investing your dollars in the marketing mix, and where’s the money going?” And the answers were, One: coming out of anything that resembles mass media, they shall go un-named; Two: moving in to niche, targeted publications where the traditional agency doesn’t have the guts to really make the recommendation, because it’s a smaller reach relative to mass. And now what’s happened is many of the luxury brands that are thinking on their feet are driving their spending to the niche publications. I don’t know whether you’re feeling that. I hope you are.

ET: Luxury seems to have become a dirty word. Does the luxury industry right now need some type of PR effort to defend its constituents? After all, lots of jobs, particularly skilled craft jobs are supported by the industry.

Greg Furman: Well, two points on that. I have always said, this was before the market started to tank. I have always said, and for years now, and I know this is part of your thinking as well, that one of the issues for luxury brands, and when I speak as you do a lot, I always talk about this, is that as the discrepancy between the haves and the have-nots becomes more radical…you know, years ago, The Times did a piece on the disappearance of the middle class. As that becomes more pronounced and more visible, as it certainly will by a business kind of an economic crisis that we’re finding ourselves in, the spotlight to your good question goes directly to those that are most lavish and most able to still retain business at the highest end. And one of the things I’ve said is that the issue for luxury brands, most of whom are very generous in their corporate giving, but are very, historically–I think this is changing, and I think it’s been changing even before the recession started to hit–the issue for brands has been, one: to not be so diffuse in their giving, meaning spread it all around the community, as we did in the old days when I was at Bergdorf Goodman. You know, this big budget, maybe $2 million, and it was spread very broadly so that they could touch a lot of people within the community. What is happening because of the spotlight on luxury brands, and all of this “luxury shame” phenomenon that is occurring, and this was happening as I say before, what brands are doing is consolidating their giving and putting a strategic emphasis to their giving, so that the not-for-profit, or charity, that they contribute to is aligned with the business itself. You know, a cliché might be Women’s Apparel and breast cancer. Or you know, the men’s store at Bergdorf Goodman and AIDS, because of the powerful gay community that shops there.

So for a while brands have been doing that, but I think it behooves brands to think much more aggressively about strategic giving, which means focus, if not all your giving, most of your giving on a single thing. And here’s the thing that was really seen as déclassé and anathema. It was seen as really low browed to promote one’s giving in the community. Well, now, I contend that a brand must publicize its giving in a tasteful way. People must know, more than ever now, about a brand’s good corporate citizenship. And if I were a brand and had an agency, I’d put an agency onto making the right communities aware of what I’m doing. So I think it’s changed the nature of how brands are thinking about corporate giving.

The other thing that’s kind of interesting is in Richistan Robert Frank talks about the evolution of corporate giving, and one of the trends that I don’t think has hit quite yet, but is going to hit, and I think he’s right on the money, is the corporate side. And this is America corporate and luxury arena as well are increasingly going to look for not-for-profits that have a for-profit mentality, that are not just looking for a dole or a handout, but are looking for ways to engineer giving and giving back on a businesslike premise, where the giving goes into some form of a social mechanism that is self-profiting and regenerating somehow. So I think more and more not-for-profits are going to be pressed to find out ways to profit from what they do in an intelligent way and recycle that. You know, create an organization that can do that, and I don’t think many of the not-for-profits are even thinking along those lines yet.

ET: Well, it’s interesting what you said, because I just read an interview with Simon Cooper. You probably already have seen it. Apparently, Ritz, because I guess they call it, has “the AIG phenomenon,” with you know all the corporate meetings being canceled at luxury hotels. But they’ve come out with a program with the Habitat for Humanity, so that when you have your corporate meeting at the Ritz Carlton, you can now dedicate part of the time where your people are going in and helping the community.

Greg Furman: Exactly, that’s one of the ways, and I think we’re going to see a lot more of that, and it’s going to be a lot more engagement with the community. And this reluctance to promote, because people thought it was a little déclassé, is going to go away very quickly, because as this thing heats up, it’s going to…It’s analogous to my old days in the oil industry, where the oil industry was seen as the cigar chomping, arrogant brand, because they were not then promoting their good work. And because promotion of good work was seen as, well, isn’t it enough that we just contribute? The community has to know.

ET: Are there any changes that you’re making to the program or the format or what you’re going to be doing as a result of everything that’s going on?

Greg Furman: A lot. One of the things that we’re doing, and people have pressed us to do for a long time, is that our traditional programming tends to be one or two two-hour sessions, speakers and panels, breakfast, lunch or an evening event with reception. And we started, I created a series called “The Winning Edge Series: Sharing Best Practices to Drive Profits.” And for the first time in the history of the Council, I have never charged for any of our events, because all our members have hosted all of the events. So the one-time membership fee covers everything. And we experimented last year in October with the pay-to-play full morning, and the first focus was customer service, and we had Jack Mitchell, who wrote Hug Your Customers and Hug Your People, and Lewis Schiff, who wrote The Middle-Class Millionaire, and the former chairman of Bergdorf Goodman who took it from a $30 million business to a $250 million business. And the focus was “News You Can Use.” Full morning presentations, but each presentation followed by an aggressively moderated panel and breakout sessions from 8 to 12:30 and charged. So we’re charging members $350 and non-members $500. And the first one, we had 40 people sign up. And I had a concern initially that people might see it as presumptuous, because they might have felt that that was included in the fee, but I didn’t have a single call. And the reviews we got from the first one were off the charts. I mean, they said it was spectacular, so much so that instead of just doing one breakout session, as I do them now, we’re going to do two. And every other seat we’ll shift. So they’re highly interactive, highly customized, and I think the need now for really interactive, highly focused exchanges of ideas with peers is critically important.

I’ve realized two things. You know, at 40 events a year, think about it. You know it’s almost one a week. The hunger for content in this community, which I think is a good thing for both of us, has only increased. I mean, and the beauty is if I do 40 events a year, you know, people have a lot to choose from. If they want to come in, you have choice on good content, practical content, news you can use. So, in addition to that, to the point about this Winning Edge Series, Sharing Best Practices to Drive Profits, we did the first one on customer service. We had 40 people show up and great reviews. So, now, coming into the year, I’m going to try and do six, maybe seven, a year.

So we’ve got two booked already. We have got one that’s going to be on the nature and extent of the crisis, so that’s going to be a full morning where we have a guru, Fred Nazem, who is a turnaround specialist, super-investor, still doing 15 percent now return on his portfolio. He’s going to set the stage and talk about the nature of the crisis. I’m going to present the survey I was telling you about, which if you want, we can talk about that.

ET: Yeah, absolutely.

Greg Furman: Larry Pimentel is coming in, because he’s done some research on the nature of historic economic crises and has spoken on that. So he had his staff and team look at the recession and other dips. And then we have two marketers who are going to talk about what people are doing right now, practical, news you can use. And then we’ll have two breakout sessions–one on how people, table by table, are feeling about the crisis, and two, what are they doing specifically. And then we’re going to use each of the report-backs and turn that into a white paper and give that to all members.

ET: Oh, wonderful.

Greg Furman: Then we’re working on another one that’s focusing on Home as Haven, you know, what are providers of home products and services doing in this window in conjunction with Elle Décor magazine. So we’re going to do that on–can’t remember the date–but soon. So I’m going to try it. Thinking about PR, I’m thinking about Social Networking, thinking about different themes that would be very pragmatic from two standpoints, get enough energy around the key speaker, but the content, as much the people at the table–and you’ve been to my events. I mean, you know how to moderate. And if you moderate well, you know, you get this great energy.

ET: And then out of the content, the Luxury Marketing Council will put together these white papers?

Greg Furman: The white paper, yeah. And then we’ll post those on the web, and that can go to all our chapters. So that’s something that we’re doing.

ET: You know, it’s interesting, as you’re talking about this, and you talk about customer service. You know, a lot of these luxury companies, you know, they have been hit because they had an aspirational consumer, and you know maybe talk about, without naming names, talk about some of the things that you’ve seen or heard. How some companies are adapting to a negative revenue environment.

Greg Furman: That is the whole gist of the survey that we did, and the question we asked, to go back to the original discussion, was…we did it in November, just before the election… I wish we had, in hindsight, had done it after, but we can do a second now for The American Express Summit… So we asked them, “How is this changing the way you look at your market, invest in your marketing mix, and what kind of operational downsizing–cuts, budget cuts–what kinds of things are you experiencing?” So what we found was tempered downsizing with a very clear notion that the best sales people with the biggest books were sacrosanct. They’re untouchable. So that was an interesting thing. We saw that most, I’d say 50 percent, were cutting ad spending. Of those that cut ad spending, they were migrating and spending more aggressively to niche publications. From a marketing mix standpoint, what we found was that in addition to cutting back on ad spending, the money that got cut wasn’t necessarily cut but re-channeled. And where they were putting it, in this order, is where they said they were putting it. One, more innovative collaborations with kindred spirit brands, so that one could share costs, have access to a new customer base. So that was one. Special bespoke customer events, where they would invite friends of their best customers, but still very intimate, to attend so as to generate new leads of customers like their best customers. And one of the themes there is to your earlier point. It was not lavish, not conspicuously lavish, but sophisticated and appropriate without being over the top. So to your point about caterers getting hit, I’m sure they are. I think what’s happening is there is a move away from lavish, massive, statement-type of events, to a little quieter, but still sophisticated, and still very beautifully done, but very niche, narrowly-focused. So maybe instead of 300 people, it’s 60, 70 people. Or, maybe it’s 20 people. So move to bespoke events, and one, single-brand bespoke events, but also through partnership and collaboration, joint types of special events, with an emphasis on content and education and value. So now, instead of just a party, there’d be a speaker or some rationalization to help people better appreciate the brand or the product or the service.

There is movement of a lot of dollars to one-to-one, with permission, e-marketing. So, based on historical spending patterns, big migration and targeted emails to that community. I mean, the story I always tell is Brendan Hoffman, who is now the president of Lord & Taylor. He was the guy that ran the catalogue and e-business for Neiman Marcus. And in six years, he took that business from a remaindering business to a $600 million business. And what he found out about one-to-one e-marketing and demonstrated was, most importantly, it didn’t cannibalize the store, and it didn’t cannibalize the catalogue business. It was the greatest source of intelligence on the best customer. It was a great lever for partnerships with brands within a store, and it enabled them to really customize this telling message, and they found that by so-doing, they increased the share of wallet on the customer by doing that. So move to one-to-one “e” is really big, tightening customer service and getting more strategic about sharing the metrics of the business with the people on the line, which used to be forbidden in the old days, you know, you couldn’t do it. So now what’s happening is people on the line are beginning to understand the impact of selling, how this week went department by department. And, in the old days, it was command and control, top down, just do your job and don’t bother me. Now what they’re saying is they’re seeing the people on the floor as intelligence to percolate information up, and asking for it, and asking for creative suggestions, because they get a lot of leverage there, so that there’s less of a gap between management’s view of what’s happening in the community and what the people on the floor see.

So heightening customer service and making the people on the line more intelligent, and then, lastly, very innovative third party testimonial generating PR that’s all about trends and value. It used to be that PR on the luxury arena was defined specifically by events. And I think more and more people realize that taking a position on trends and style, what’s in and what’s not, is very important and engages the consumer, because what we found is the biggest issue for the Council CEOs, still, if not people finding, motivating, educating, succession planning for compensating, that was one. And the other was educating the best consumer about the price value equation. So that hunger to know, and what I call “rise in connoisseurship” on the part of the best customer is a big piece of what brands are trying to do now, is get the best customer to better appreciate the value, the quality, and by so doing, make them a better informed consumer and a more aggressive buyer, because they better appreciate. And I think I hit them all, but that’s where I think it’s going.

ET: You know, obviously, as someone who spent a great deal of your career in the luxury arena, you know, the line of pitch was always about the craftsmanship, uniqueness, the value of what you’re getting. And then, all of a sudden, brands where you would never see call to action in price promoting…

Greg Furman: I knew you were going there, right.

ET: I mean, we understand that you got to sell, you got to sell, but do you have any concerns, just seeing what’s happening in the marketplace?

Greg Furman: I do. I think that there’s discounting and there’s discounting. I mean, I think the way Bergdorf does it quite intelligently is they have special best customer sales, where they won’t plaster it on the billboards in Times Square. There are some brands that shall go unnamed that are really taking a very radical approach to cutting the value of best merchandise, and really just starting to feel like Costco. I think that trains the customer to question the underlying premise of what Stanley Marcus called “Impact of the Hand,” craft of manufacture and value. So, my theory on that, you know, I’m not running these companies, but my theory on that is that that conditions the customer to understand there’s a big margin where there’s flexibility. And the customer is very smart. And I think that’s just conditioning customers to not want to pay right prices. So I think it’s a disaster strategy, in my opinion. I just think it’s the wrong way to go.

ET: Just talking globally, you said, what is it? 28 chapters?

Greg Furman: 28 cities worldwide.

ET: So maybe give us a little overview from the different markets that the Council is representing. Any markets doing better than others?

Greg Furman: Well North America, I think we’re all in the same sewer. So everything I’ve talked about, you know, in cutting back on advertising, concern with reengineering marketing mix, manpower, how to deal with the disparity between haves and have-nots, all that that we’ve already touched on, holds for our market. And, again, you know, I’m not an economist, but just as you go globally, meaning I think Brazil is still robust. So they’re robust, and they’re still in the early stages of conspicuous consumption, and that’s true of Hong Kong, and that’s true of India. So they are in what American Express called the “acquisitive” stage of the luxury buying. So Russia, even though we’re not there, I’d like to be, but where brand is everything. The ability to say how much it cost and taut the fact that one can afford it, that’s a fairly new market. There, the whole idea of marketing, and the restraint of the media in terms of how it’s evolved, they are still, many of them, early on relative to say North America or Britain, or the pan European. So there, I think they are in the early stages. I think they are going to feel this. I mean, that’s the simplest way I can say it, and we’re going to have to hustle more to have people market more aggressively. The U.K., I think, and Europe, are now starting to shake out. You know, it seemed like it was first the U.S., but now I think we’re hearing similar rumblings across Europe, and I think they’re going to experience a lot of what we’re experiencing. So, I wish I could be a little bit more articulate on it.

ET: Talk about just even the Council. If some of the member companies are having a difficult time, it’s harder to justify membership or get new membership. Is the Council being affected?

Greg Furman: Well, I’m seeing it in terms of last year was a good year. Last year wasn’t my best year. It was my second-best year, and the reason it was the second-best year, and I think this is consistent through all our chapters, was because of the timeliness of payment was an issue. This year, I don’t know.

ET: When you say “timeliness…”?

Greg Furman: I mean, I’m sitting on a lot of receivable. You know, I mean, people are paying slower, I’m having to bird-dog them.

ET: So no resignations, but slower payments.

Greg Furman: Our retentions through ’08 were just fine. In fact, counter-intuitively, the number of requests for participation in the Council, from a member standpoint, all time high requests. And the number of interests from cities with perspective licensees, where we don’t have a presence–Beijing, Shanghai, Sydney, Johannesburg, Moscow, Rome, Milano, Geneva, Zurich–I am now having discussions with more and more prospective licensees, people like us who are entrepreneurial, that have a portfolio but also want to take the high ground as a thought leader. So I’m seeing more of that, counter-intuitively. So, one way, and again, I can’t tell you…I’m nervous as hell, which is why I think my message to the communities is community, the leverage of community, of our buyers and of our members and the power that that gives us to find economies of scale and be smarter together. So I’m concerned, you know? But I can’t tell you yet what the shakeout is going to be, because I’m still collecting. In three months, I’ll tell you!

ET: Did luxury bring its own hangover? Did some of these companies expand too much? And do you think there are lessons learned from this, which was a great period in the last 10 years, or will it repeat itself again?

Greg Furman: Well, I mean, my theory on this is, this too shall pass. My issue with luxury in this window is in some respects it’s the same issue that I’ve had in founding the Council. Which is, if I said I had one wish for luxury, and if I were to be slightly critical, I would say it’s not so much an issue of expansion as it is having the position of heavy reliance on image advertising and not, even in robust times, because times were so robust, digging deeper to leverage every other facet of the marketing mix–database marketing and segmentation, which in a lot of brands is still a lost art, one-to-one web, heightened customer service, loyalty programs. All of the classic, packaged goods tools in the arsenal of the marketing mix, I think are relatively, and I’m not talking about everybody of course, to many of the companies that should know better, they could do a lot better if they were hungry. So my critique would be maybe the good times left them not as sharp and hungry as they might have been, and the only thing that can push one to that is tougher times. And my hope, from a self-serving and Council standpoint, is that what it’s going to create is a new sense of awareness that, especially volume-wise, the symbolic and aspirational buyers have disappeared, but the money has got to come from the ones with the most money, and it’s got to be a whole new way to go after that and engage. And I think those that do the best customer marketing along the lines of classic packaged goods strategic marketing are going to do very, very well and come out of it punching strong.

ET: Tell us a little bit, when you’re not doing the Council, tell us about some of your hobbies.

Greg Furman: Right. Well, my passion is the arts. You know, so I write. I write a book of poetry every year. I’m an English grad, right? And so always a liberal arts kid, and I’ve always loved the arts. It’s just what gives me peace and rest. I mean, for me, it’s love and family, nature, and arts. That’s it. Love and family and friends, nature and arts. So, when I was doing a lot of writing for a living, a lot of writing, and I was a speech writer and journalist, you know, you just come back from the 10 hour day, the last thing you want to do is write something. So I always loved the visual arts, and I started painting and sculpting. And I have been doing that for 30 years. And it’s a nice little studio that Wanda built for me upstairs in the tractor shed in one of the barns, you have to come sometime, in the country property, and I take a little scotch and put on the fireplace and close the door, and I sit there for three hours and paint!

ET: So you are having some commercial success, I assume?

Greg Furman: Yeah, a little bit, just now. I have retained an agent, who is terrific, just recently, and about a year ago, I had a little show up in Bridges County and sold quite a few paintings, which was a couple of bucks. And it’s fun.

ET: Right. So is this still a passion, or is it becoming a business?

Greg Furman: Well, you know, I don’t want to have 30 years of art sitting in the tool shed! I want to merchandise it. I really want to get aggressive about it, and I think, it’s funny. This show last year kind of, I’m not shy at all, as you know, about marketing, but I’ve always been a little bit bashful about pushing the work. And I think when I saw the work sold, and it’s not like real gallery art. I mean, the $10,000 range, so it’s modest for sales, but, for me, that’s significant, and it’s in the collection of the Bulgari family and the chairman of Publicis, and that kind of put some wind in my sails, and I thought, “Hell, I got so much…alls I got to do is get it off the shelf and out it to the community, and maybe it will be a small piece of the portfolio.”