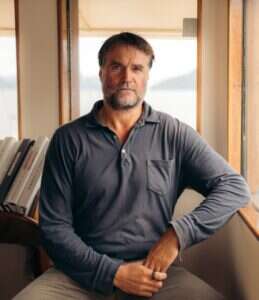

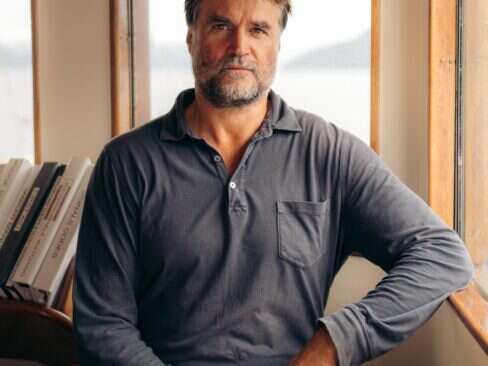

Chairman & CEONetJets

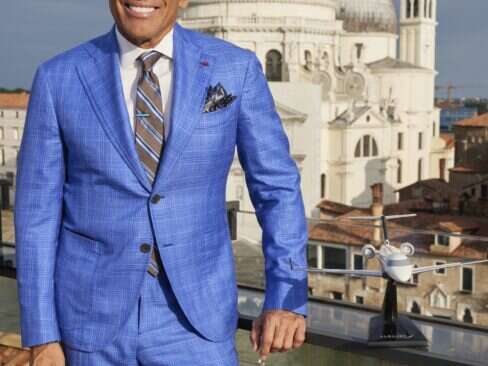

Last Spring Jordan Hansell moved into the left seat as NetJets’ Chairman and CEO replacing rumored Warren Buffett successor David Sokol, who himself had replaced legendary founder Richard Santulli only 18 months before, all this cockpit maneuvering as the private aviation industry was pulling out of its most challenging period ever. Having continued to guide the world’s largest private jet operator to clear air, he is now mapping flight paths to Asia and bolstering the company’s product offerings in its core North America and Europe markets. Recently Elite Traveler Editor-in-Chief Douglas Gollan flew to the company’s brand new Columbus, Ohio headquarters where the previously unknown Iowa native discussed his world of dreams. Photo: Courtesy of Erik Rasmussen, NetJets Inc.

ET: What was your background before joining NetJets?

Jordan Hansell: I was involved in a few different industries before joining NetJets. I worked in government (as a law clerk to U.S. Supreme Court Justice Antonin Scalia), private business as well as transactional law. I am a trained lawyer and I received a degree in public policy while I was getting my law degree. At one time I thought I wanted to be a politician, then realized while there are a lot of fine politicians, it was not for me. Immediately before joining NetJets I was working with my father at a law firm in Des Moines, which was something I always wanted to do. We had about 100 lawyers in the firm. When he decided he wanted to retire, I started thinking about what was next for me. The NetJets opportunity presented itself unexpectedly.

ET: When you joined NetJets as Chief Legal Counsel in 2009, were you a private jet flier?

Jordan Hansell: I had used private jets. I had flown with NetJets owners. I experienced the NetJets service and realized the value it offers, but I wasn’t a private jet owner.

ET: What were your biggest surprises entering the industry?

Jordan Hansell: The industry is a small place. Everyone knows each other, and it’s a place filled with accomplished and talented individuals. One of the other surprises is how down-to-earth our owners are.

ET: Your customers represent the most successful people in the world. Do you ever go to them for advice?

Jordan Hansell: One of the biggest advantages is being able to tap into the knowledge of our owners. Once a quarter we have a meeting with our top 45 NetJets executives and we bring in a NetJets owner- usually a CEO or someone with a successful business background. They talk about their career experiences, which offers our executives a great opportunity to learn from a select group of people.

ET: When you were named Chairman and CEO, you were unknown, even to the degree that the only person BusinessWeek could find who knew you to comment was your father?

Jordan Hansell: They got a hold of him before I could get a hold him.

ET: Did Warren Buffett give you any advice when you were named Chairman & CEO?

Jordan Hansell: He did give me some advice. It was short and simple. Run the business like you own it.

ET: Do you go to him for advice often?

Jordan Hansell: He’s helpful, and he’s remarkably hands off, but he is always available if we need to consult him, which we do when we are making significant investments such as our aircraft purchases We have an order for $6.7 billion long-range (Bombardier Global Express) jets, $1.3 billion in (Embraer) Phenoms, and we are close to making a substantial order for mid- and super-mid size jets. His advice is always helpful.

ET: On any given day, the business news cycle has troubling stories about Spain’s economy, varying U.S. numbers and concerns about China. What’s your outlook?

Jordan Hansell: We’re very optimistic on a global basis. We are cautiously optimistic about the U.S. Consumer confidence is trending upward. The housing market is reducing inventory, so new construction will create jobs. We see China as an opportunity for growth potential, but keep in mind 8 percent growth is what’s required to employ new entrants to their workforce.

ET: Recently you announced a joint venture that will put NetJets in China. Is this Warren Buffett’s Good Housekeeping Seal of Approval that the private jet industry there is coming of age?

Jordan Hansell: Yes, I think that’s a good way of putting it. We think China is a wonderful opportunity. It’s still developing. There’s a long road, but the Chinese government has included general aviation in its next five-year plan, so this is a positive sign. There are plans to build dedicated private jet airports, much like Le Bourget is in Paris or Farnborough in London. We’ve already hired employees and we are getting ready. Our expectation is we will get regulatory approval in the next 12 months.

ET: How do you see the China business evolving?

Jordan Hansell: We hope to have a near-term management business of whole aircraft for third party owners and then a charter business chartering the aircraft. At this point, we don’t see the Chinese market as ready for a fractional market, but it is a possibility for the future.

ET: After China, are there other markets we might see you expanding too?

Jordan Hansell: We’re interested in all of Asia. Indonesia makes sense, but we’ll wait and see. Everybody talks about South America. But unlike the E.U. it is composed of different countries, each with its own regulations so that becomes a challenge. You can look at Brazil, but then it becomes a micro-market. We’ll start looking at the Middle East again. With NetJets’ global scale, we are flying into all of these locations already. NetJets flies to more than 170 countries every year.

ET: In Europe you just added management?

Jordan Hansell: We are expanding our global private aviation offerings. In the U.S. we already offer fractional shares, leases, jet cards, management and charter. In Europe we will offer a full range of solutions. We had (fractional and jet card) customers in Europe who owned jets saying, “we want you to manage our jet.” After that happens enough you take notice. In the U.S., we have a new owner referral program, a new interchange program for Marquis Jet Card owners flying in Europe and a Marquis Jet X-Country Card that provides significant savings for those that regularly fly cross-country. We are also in the process of launching a new corporate product for flight departments.

ET: What is the financial profile of individual owners, and has the mix of products you are selling—fractional and jet cards—changed?

Jordan Hansell: For fractional, investible assets of at least $30 million and for jet cards, $10 million. Our mix has remained remarkably consistent. With wealthy owners from big corporations, the private jet industry seems to always be in the line of fire from politicians and the media?

ET: With wealthy owners from big corporations, the private jet industry seems to always be in the line of fire from politicians and the media?

Jordan Hansell: Only three percent of U.S. registered business aircraft are operated by Fortune 500 companies, and the benefit is that private jets access over 5,000 U.S. airports compared to 500 for commercial airlines creating business opportunities that create jobs. We need to remind people we are a strong industry. We employ 1.2 million people in the U.S. and contribute $150 billion to the economy. We are one of the few industries with a trade surplus. We create very high paying jobs—pilots, dispatchers, maintenance, manufacturing. Business aviation makes an economic contribution in all 50 states, and right here in Ohio general aviation is responsible for approximately 17,000 jobs and more than $490 million in annual payroll. We have to look for opportunities to get better at sharing the facts about what we bring to the table. We have the truth on our side.

ET: In terms of fleet, is the pendulum swinging towards larger, long-range jets?

Jordan Hansell: People want to have the flexibility to go the long distances. It’s globalization. You can go short distances in a long haul jet but you can’t go long distances in a short haul jet. There’s a lot going on in engine technology being developed that will enable even longer-range jets, and cabin technology providing higher humidity and lower altitudes, which makes it more pleasant and reduces the jet lag when flying long distances.

ET: Facebook’s record setting IPO was all about the value of the data it has on its users. NetJets customer list is probably one of the most valuable lists in the world. Any thoughts on how you could leverage it, or market the list?

Jordan Hansell: None. Privacy and confidentiality are part of flying with NetJets. We keep that as a position of trust. I have three children, and they ask if this person or that person flies with us, I tell them that I can’t tell them. We don’t disclose any information on our owners or their guests.

ET: Are there any enhancements you are planning in terms of customer service?

Jordan Hansell: Right now, approximately 90 percent of our fleet has Wi-Fi. We are tweaking our new jets to make them specific for us. We are going to introduce new features and really customize the in-flight experience to make it even better. As an example, our Global Express galleys will be in the front, where the flight attendant rest area is, so you won’t have traffic in the cabin with the flight attendant going back and forth. We’re making large investments on the ground, as well. We have our own private terminal facilities in White Plains and facilities opening in the near future in Van Nuys and Palm Beach. We have a facility in Teterboro that is virtually like our own terminal. There are about 14 or 15 markets where we are looking at possibly opening private-use facilities. Atlanta is one example.

ET: Anything else you would like to talk about?

Jordan Hansell: We’re particularly proud of our safety culture and, secondly, our service culture. I get emails everyday from the field about customers talking about service levels and special things our team did for them We think we have one of the highest service cultures of any company in any industry. People don’t recognize it until they feel it.