CEOsAsia Jet Partners and Metrojet and Heliservices

Asia is becoming a hotbed for private aviation. The ramp at Hong Kong International Airport now features as many as 30 or 40 private jets waiting for their next mission. Two of the faces leading the charge are Chris Buchholz, CEO of Metrojet and Heliservices, and Justin Lee Firestone, CEO of Asia Jet Partners. During a recent trip to Hong Kong, Elite Traveler Editor-in-Chief, Douglas Gollan, met with Buchholz and Firestone at Felix atop The Peninsula Hotel in Hong Kong, appropriately run by Metrojet Chairman Sir Michael Kadoorie who is also Chairman of Hong Kong & Shanghai Hotels. The conversation ranged from the future of general aviation in the region to an expat’s guide to Hong Kong.

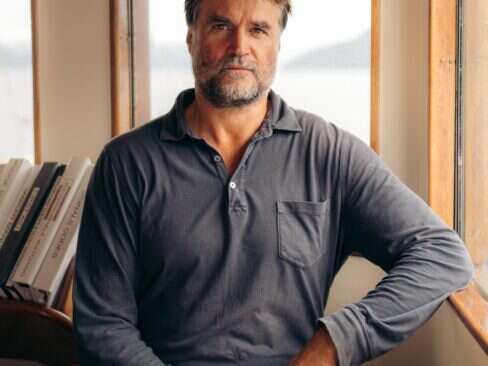

ET: Gentlemen, let’s start with Chris. You’ve been out here for a while and obviously in Asia the private jet market’s taking off. Why don’t you talk to us a little bit about your history, coming out to Asia and how you’ve gotten involved in the general aviation market?

Chris Buchholz: When I graduated from college I was in the U.K. and at that time Asia was an extremely dynamic place. So I was considering where to pursue a career and I was looking at whether or not to pursue a career in finance in London or in Hong Kong. Hong Kong was a no-brainer for me. The growth out here is very significant. It’s an extremely dynamic place. People work hard and play hard out here in Hong Kong and it’s been a fantastic place to be. I’ve been in finance most of my career—debt capital markets and mergers & acquisitions—but I’ve always had a passion for aviation. Ever since I got my commercial pilot license and my jet rating, I decided this was so much fun I had to get into it.

Having been trained as a commercial pilot in the United States, where general aviation is so pervasive, it was very clear to me that in Asia there was virtually no business aviation. There was one aircraft in Hong Kong owned by the Kadoorie Group. Therefore I approached the Kadoorie Group and Sir Michael and told him that surely this market could really grow. So I shared my ideas, we shared some ideas together and the opportunity came for me to help grow his business. And it’s been very exciting. I’ve been in the business now for four years. We had one aircraft at the time. Now we operate ten jets, we also have eight helicopters and the growth at the FBO has been 20 percent a year for five years straight. So it’s been very, very exciting. And I think we’re just seeing the beginning of the proverbial S-curve, and we are set for a lot of growth over the next two decades.

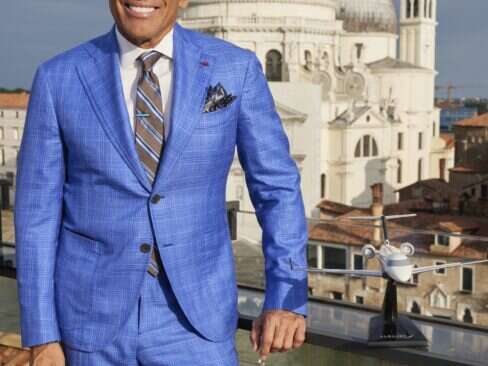

ET: Justin, why don’t you talk about your career, how you got into private aviation and what brought you to Hong Kong?

Justin Lee Firestone: My career started in the U.S. with a company that’s now called Sentient Jet. I was with those folks for two years at a time when charter brokering was really the only way to go. The fractionals were not allowing you to utilize their fleet unless you owned a fraction. So I did that for two years and then was headhunted to work with Marquis/NetJets, which gave me a great platform to build a career and was a lot of fun. I was with those folks for six years mostly running their sports and entertainment business. Along the way one of my clients was an Asian tycoon who identified the market here. It just sort of came together, and here we are a couple years later in Hong Kong. It’s been a tremendous opportunity. I equate what’s happening in private aviation in Asia to the breakthrough about ten years ago in the U.S. Chris just gave you a snapshot of the numbers, but if you walk out on that ramp any day here in Hong Kong you can smell the jet fuel and you can feel the energy. I think even in a downward market, this is a business that will grow and has to grow relative to the rest of the world. So it’s great to be here.

ET: Tell us about Asia Jet Partners, where your company is in the launch process and what your plan is?

Justin Lee Firestone: We are currently operating the largest Gulfstream fleet here in Asia. We have additional aircraft on order with more aircraft acquisitions soon to be announced. Metrojet is Asia Jet’s operating partner. Together, we have formed an exclusive strategic alliance with Metrojet and we are marketing access to a growing fleet of five G200s here in Asia. The recently announced partnership between Metrojet and Asia Jet is much like the symbiotic relationship between Marquis Jet and NetJets back in the USA. I arrived here and needed an Asian-based operating partner. I wanted Asia Jet to be a sales and marketing organization and it was very evident early on that Metrojet, the Kadoorie Group and all that they stood for was something that was just a no-brainer. They’re the largest operator in Asia, they are fanatical about safety, offer five star service and operate the largest fleet of aircraft in Asia. So we will essentially launch a charter card program—card fractional, if you will—that will be happening in early 2009.

ET: Now, I’m sure a lot of people are familiar with how the card programs and the fractional programs work in the United States. Any variances in how the program’s going to be set up here?

Justin Lee Firestone: Here in Asia, because you don’t have the critical mass, you can’t guarantee a jet at all times like in the USA or Europe. With Asia Jet, availability is usually guaranteed since we have the biggest fleet, but you can’t promise availability, otherwise you’re setting yourself up for failure. I think the other thing here that’s a little bit different is that you need to work with an operator that is very familiar with operating in Asia. They are not very forgiving when it comes to making mistakes on permits and things like that.

So as the product rolls out you’ll see it’ll be a debit format where a customer puts in a prepaid amount of money and deducts from that balance. In Hong Kong they have something called an Octopus Card, which you can use for all your spending—on the subway, at numerous retail shops—and this is essentially an Octopus Card with a lot more money on it. But the other thing you won’t be able to do is guarantee a specific type of aircraft. So at Marquis Jet you can do a 25-hour card on a G200. Here we can provide a G200 most of the time because there are so many of them, but you won’t be able to guarantee, at least for the first few years, any specific model until you have the critical mass in the fleet.

ET: Chris, maybe you can talk to us about business aviation in Asia. Why maybe has it been a slower takeoff than in places like the United States and Europe? And what have you seen, from Metrojet’s perspective, are some of the changes taking place in the market?

Chris Buchholz: It’s very interesting. Business aviation, and general aviation as a whole, was invented in the United States. Aviation was invented in 1903 and there are more jets today in Los Angeles than the whole Far East combined. That says a lot. There were more private aircraft in the 1930s in the U.S. than there are today in the Far East. So we’re many, many decades behind the United States. Now there are some reasons for that. It’s certainly not for the lack of wealth. Based on the kind of wealth in Asia, you would expect a lot more private jets zipping around the whole of Asia.

Asia’s been very slow in taking off with business aviation and there are a number of reasons. First of all, I think there is a fundamental lack of general aviation awareness in Asia. Essentially, you only see airlines or perhaps some military aviation. There’s very, very little general aviation. Here, if they only know Cathay Pacific First Class or Singapore Airlines First Class, that’s all people often know. Unless people were actually aware of the benefit of business aviation, nobody would buy business aviation because they wouldn’t think of it. Also, in Asia there’s a critical lack of general aviation infrastructure. For instance, there are far fewer airports. Think about the United States and how many airports there are compared to how many airports there are in China. In China you have far fewer airports. In the United States you have more than 5,000 airports that you can use a Gulfstream in. If you include some of the lighter jets, there are over 10,000 airports in the United States. Well, China has barely 100. So it’s a huge difference.

And virtually no airports in Asia have an FBO. So in a lot of places we have to use ground handling agents. When we land at a main airport, we use a ground handling agent, then often go through the main terminal and then through the immigration channel. So in Asia you also lose some of the point-to-point benefits. That’s changing very rapidly. You’re seeing more and more FBOs, you’re seeing ground handling agents becoming more and more efficient, FBOs that are getting a lot better at processing VIPs that are disembarking and embarking on the private jets. So that’s improving a lot. China’s building a lot more airports all the time so that’s very promising.

I think another reason why Asia’s so far behind, besides the reasons I mentioned, is that in Asia what we call handling costs—essentially landing fees, over flight fees, ground handling fees—are astronomically high. In the U.S. these kind of user fees are essentially zero. The last couple of years the U.S. Congress has discussed whether or not to implement user fees. Right now that hasn’t happened yet, and we certainly hope that doesn’t happen in the U.S. But even so, for the moment the U.S. has essentially zero fees. In L.A. you have more than half a dozen airports—you can even choose a neighborhood in which you want to land, which is fantastic. In most of Asia here you basically have one airport per city, and that’s fine, but that means that we have to use major international airports with very high landing fees. So that means that it doesn’t really make sense for people to buy a very small aircraft or a personal jet. If the landing fees are the same as a 737 then why would you buy a very light jet?

So that means there’s a huge chunk of the market that simply doesn’t exist yet, and that’s the very small jets. As fees become lower, I’m confident that you’ll see more of that small-jet market. But right now there’s a propensity for the larger jets. The tendency you see for large jets is probably because of the very high fees, but there’s another reason. People here are not used to general aviation. Before they were very successful, tycoons or successful entrepreneurs in the United States might’ve had their own propeller plane or small Citation and then upgraded to a Gulfstream. Here you don’t have that. All they know is Cathay Pacific First Class or Singapore Airlines First Class, which have very wide cabins, standup cabins, full linens, silverware, five course dining and they even provide turn down service. You just can’t deliver that kind of experience in a very small jet. So that’s another reason why the market’s still very small for the moment.

Justin Lee Firestone: I think a key issue is infrastructure, and that’s something you hear thrown around loosely within the private jet space when folks talk about Asia. I certainly heard the word a lot before I got here last year. I’ll say infrastructure is an issue in Asia. However, I think it’s more of an issue with a company that’s trying to operate in Asia from the U.S. or from Europe. Companies that operate here know how to get the job done. That’s why for us it was a no-brainer to work with an Asian-based organization like Metrojet. So if you’re going to charter with Asia Jet , I think a lot of that infrastructure won’t be as much of an issue. If you rely on a company that’s trying to do this out of Chicago or Teterboro, it’s going to be more of an issue as far as landing slot, permits, handling fees. You know, if you fly over Vietnam and you don’t have your permit number with the dashes—even if you’re in the air at 40,000 feet—they’re going to tell you to turn around. Asia is not very forgiving when it comes to operating business aircraft in this region.

The other thing I think I just want to touch on is cabin class. The smallest charterable private jet in Asia is a Hawker right now. Charterable Learjets and small Citation jets hardly exist over here. So that’s a huge difference. That just goes back to the idea Chris was talking about with Cathay Pacific, Singapore Airlines, five-course meal service—folks just don’t want to get into anything smaller. It will eventually change, but right now it’s interesting to see that the smallest jet on a ramp is a Hawker.

Chris Buchholz: I’d like to talk a little bit more about the luxury aspects here. In Asia, rather than midlevel executives or bankers or lawyers using these kinds of private jets you’re really talking about the major tycoons and business leaders using private jets. We haven’t seen really a big change for the business professional yet because the barriers of entry are high here.

For us, we’re very well-positioned for catering to the luxury market. The Peninsula Hotels is our sister company. We share the same chairman, we have very similar shareholders, we’re fully owned by the Kadoorie Group. Service excellence for us is something that we take very seriously. Service is extremely important here in Asia. In the U.S. most jets fly around without a flight attendant and that’s fine. A lot of people in the United States fly business aircraft, primarily for efficiency—getting from A to B and saving time. And that’s great. We would like to see more of that in Asia, but for the moment we’re seeing very much a strong desire for a very high level service.

For us, we don’t charge any extra if people want to have caviar onboard. That would be unthinkable in the United States. You would always charge extra for catering—for us it’s all built in. Our flight attendants are all cross-trained here at the Peninsula Hotel Hong Kong. They obtain exposure in sales, in the kitchen, restaurants and even housekeeping. So there’s a lot of cross-training. If you see the 14 Rolls-Royces downstairs, the Phantom Rolls-Royces, we share best practices in terms of how to take care of leather inside our aircraft with our colleagues here who take care of the Rolls-Royces. There’s a lot of synergies between us in terms of philosophy. In fact, we also serve Peninsula-inspired dishes onboard our aircraft. So we think that’s quite unique as far as Asia’s concerned.

ET: Justin, logistically how do you plan on having your company be able to service, on the spot if you will, businesspeople from the U.K., from Chicago, from L.A. who show up here and don’t have access to your card and readily available knowledge of what you offer?

Justin Lee Firestone: I think Chris identified that years ago by putting a private jet model behind the Peninsula concierge stand. Certainly a la carte is part of the business. I think, what you asked is also multinational business, right? While we are going to really cater to the high-net worth individuals living in Asia, folks that are coming in commercially are also a big part of our business. So we’ll be able to service them a la carte, if you will. It’s not going to be a big part of our business, but with the largest Gulfstream fleet in Asia, we certainly will be able to handle those requests very easily.

Chris Buchholz: To add to that, interestingly enough, for many years a very significant component of our business was repeat customers from North America who fly on the airlines and then need a private jet locally to fly around. So for those companies that fly a lot, using Asia Jet would make a lot of sense because they would often require an aircraft, and I think a card would make sense for them.

ET: Lufthansa Private Jet has had that successful model. So talk about who you think the customers are going to be split between business and leisure. Is it going to be between the main destinations or is it going to be the secondary places like Phuket or between secondary cities in China? Where do you see the business coming from?

Justin Lee Firestone: About the Lufthansa deal, I think there’s something so great about getting off your 747-400 series jumbo jet and getting into a Rolls-Royce at the bottom of the gate. We’ll hopefully take a page out of that book here in Asia. I think the regulatory climate is a little different here, so you have to make sure that you meet the stringent standards, but we’ll be able to do that.

The business here is a little different than the U.S. In the U.S. it’s, I’d say, heavy leisure followed by business. Here, as it is today it’s mostly business followed by leisure—at least in the charter market. I think for some of Chris’s management customers, there is also a significant leisure component. But I think for our initial business model, we’re focusing primarily on the business market followed by the leisure.

In terms of the destinations today, if I had to put a number on it, I’d say about 70 percent Southeast Asia, 30 percent China. We anticipate that will probably flip-flop in the next two years. Destinations like Phuket, Bangkok and Singapore are big destinations. Sanya is in China, which they dubbed the Hawaii of China. Ritz-Carlton, Four Seasons and Mandarin Oriental are all, if not already open, opening in the next six to 12 months. So we initially will focus on Southeast Asia and Hong Kong, but very soon thereafter you’re going to start to see a lot of demand. Much of the wealth being created today is in mainland China, but you’ll start to see more demand come out of China. And I think Japan is not too far behind in using private aviation as well.

ET: One of the hot spots here, not too far from us, is Macau with the continued boom in gaming, and then there are integrated resorts down in Singapore. So what role, if any, for your business do you see gaming travel having out here?

Chris Buchholz: Macau is a very interesting place, because finally, as you know, they have removed the monopoly on the gaming industry. I think that’s been a very healthy thing for the market. You see the standards in the gaming industry really increase because of increased competition. You have people like the Sands and the Venetian, you have people like MGM. Everybody’s there. It’s a very, very exciting place. And as you probably have read, the gaming revenues in Macau have exceeded those of Las Vegas, so that’s very exciting.

You do have some of the casinos who have their own small fleet of business jets to carry their high rollers. Now it remains to be seen, and it’s still too early to see, whether or not those aircraft will stay in the region because it’s dependent on having a significant percentage of their clients being high rollers rather than just the typical gamer. I think, yes, gaming will be a part, but I think aviation is really client-driven. Where the clients want to be, Justin and I will be. It’s a client-driven business and very exciting. You never fly to the same place in exactly the same profile on the same day. Everyday is different and that makes it very, very exciting.

We do fly to Macau, and in fact a couple of times we’ve flown from Hong Kong to Macau. It’s not ideal to serve our discerning clients on a private jet, but nevertheless we have done that. It makes more sense, in general, to use one of our Peninsula helicopters for such a short distance, which we can do as well. But Macau for sure is definitely part of the market. For Singapore, I think an increasing amount will be convention-related. We fly to Singapore all of the time and I don’t think that will change because of the emerging gaming industry there.

ET: Can you give us a brief overview on private jet travel increasing here in Hong Kong and any other data points from here in Asia?

Chris Buchholz: Actually, our Group is a major shareholder of the FBO in Hong Kong. For the last five years, until the end of last year, we had a compounded annual growth rate of about 20 percent every year at the Hong Kong Business Aviation Center, which is the only FBO in Hong Kong and the busiest FBO in Asia. Last year, we had 3,600 movements. This year we project about 4,300 or 4,200. Next year, because of the current market conditions, we probably expect that to be a little flat. Nevertheless, in the medium and long-term, we expect growth to be very, very strong for the region as a whole.

In addition to being one of the leading operators in this region, we also are the only 24/7, 911 hotline for non-Asian based private aircraft that pass through Asia that need immediate maintenance support. Our return-to-service activity has more than doubled from the first nine months compared to the whole of last year. We’re seeing a lot more transient business, so that’s very encouraging. So the market is here to stay. In fact, what we’ve experienced during the latest market turmoil in recent months is the number of aircraft that pass through Hong Kong remains strong. I believe that a lot of the business leaders will be increasingly busy in trying to make sure that their relationships in China will continue to work smoothly throughout this process, and they will continue to use business aviation as an important tool.

ET: Down at the Singapore FBO, JetQuay does both the private operations and then they also do VIP First Class. Have you ever thought about that or is that maybe in the plans for the FBO here to also do some VIP First Class for the commercial airlines?

Justin Lee Firestone: I think the mixed-use play is a unique angle. I spent some time at JetQuay and I think you’re going to probably see more of it. In today’s market there isn’t a demand yet in some of these second-tier cities. I’d say in Beijing you’re going to have a true FBO. It just opened a couple of months ago. Hongqiao Airport in Shanghai, which is opposite Pudong, is supposed to be done at the end of 2009.

It’ll be Shanghai’s first dedicated FBO. I think in some of the other cities you’re going to see this mixed-use play because it makes a lot of sense. It’s not as risky if there’s commercial business there as well. So I think what JetQuay is doing is attractive because you’re catering to the same client. Believe it or not, Cathay Pacific First Class from Hong Kong to New York is $25,000 U.S. So whether they sit in a recliner in a charter from Asia Jet with me or they sit in a recliner in Cathay, that private terminal’s going to cater to that client.

ET: Sometimes you get caught in the immigration lines and they can be long. It’d be nice if you got picked up plane-side.

Justin Lee Firestone: I think the unique thing about Hong Kong is every flight out of Hong Kong is an international flight. There’s no other airport in Hong Kong.

ET: And obviously you have customs and immigration facilities at the FBO.

Chris Buchholz: That’s right. They’re dedicated facilities so that every time there’s a business jet movement, customs and immigration arrives early and leaves only after the airplane has finished its movement. So that’s available 24/7. So there’s never any queuing, which is fantastic.

ET: Let’s get off the subject of business for a minute. So tell us a little bit, gentlemen, about the great city of Hong Kong. What do you guys do when you’re not working out here? What are some of the great leisure activities that you like to do?

Chris Buchholz: For many years I’ve taught scuba diving on my weekends. Hong Kong is about 1,000 square kilometers in terms of land mass and about 3,000 in total, including about 2,000 square kilometers of water with a lot of different islands. So there’s a lot of water sports here. A lot of people go yachting, sailing. I go scuba diving. That’s my cup of tea. You can fly a small Cessna here or a private helicopter. Hong Kong is almost the size of Rhode Island, and there are considerable outdoor activities to do. So for me, scuba diving is probably the big thing, and of course golf is very popular here in Hong Kong as well.

ET: Where would people play golf? How many golf courses are there? Are you able to get access? Can you guys help get access to customers of your company?

Chris Buchholz: Absolutely. In fact, a floor up from where you are right now, we have two helipads—the only hotel rooftop helipad in Hong Kong. We can fly from the helipad upstairs directly to the golf course.

There are some public golf courses on some islands, and there are also some private golf courses. So anyone can have access to golf here. There are, of course, a lot of city driving ranges as well. So Hong Kong is a fantastic place, really dynamic. It combines the best of East and West. It has the efficiency and the rule of law based on English Common Law—after 160 years of British rule—but it also combines the Asian entrepreneurialism and the phenomenal work ethic, which is really second to none. And it’s a real privilege to live out here.

ET: Justin, you’re new here. Any particular fun things you’re finding to do when you have some time off?

Justin Lee Firestone: I love to travel. If I’m not completely wiped out after a long week of work, I’ll jump on a plane. In an hour you can be in Sanya; you can be in Thailand in a little longer than an hour. Macau is a $30 high-speed ferry ride. There are beautiful resorts there. If I’m not traveling, I just relax and enjoy myself; the culture here is great. People are friendly. You look out the window here and you can’t help but feel the pulse of the city and the energy. I’ve heard many times that Hong Kong is New York on steroids. That couldn’t be a more accurate description of this vibrant city. So it’s been great.

ET: Last question. In the United States, there’s Richard Santulli of NetJets, the father of fractional ownership, and then Warren Buffett, the oracle of Omaha. Out here you obviously have Sir Michael, who’s well-known for his passion for aviation, for the great Peninsula Hotels and his passion for technology and great automobiles with your fleet of Rolls-Royces. So do you see any connection or contrast between what Santulli and Buffett have meant to private aviation in the last ten years in the U.S. and somebody like Sir Michael Kadoorie behind you guys here in Asia?

Chris Buchholz: We know NetJets very well, and they know us very well. One similarity between our respective visionaries is the mandate they have given us, which is to use whatever resources are necessary to be safe and spend whatever resources to stay that way. Right now NetJets is focusing on Europe and North America, and we are focusing on Asia. I think NetJets is a remarkable story. However, I think it’s very, very difficult in Asia to replicate NetJets exactly the same way in terms of guaranteeing availability and having zero pricing for repositioning aircraft to pick up passengers in another city other than where the aircraft is actually based. It remains to be seen what NetJets would like to do out here. For us, our heart is in Asia. The Kadoorie Group has been in Asia for well over 120 years. Avaition and service excellence are things that we feel very passionate about. And we’ve worked with a wide variety of high-net worth individuals who choose to fly privately in Asia. More and more people use us as a way to augment their business. Since, at present, Netjets does not have aircraft based in Asia, they quite often rely on Asia Jet to fly some of their customers around the region. I think we’ll see more and more cross-referrals going forward. We have not only flown their customers in Asia numerously, but we continue to support any maintenance needs they may have on their U.S.- and European-based aircraft that happen to be in Asia.

ET: Anything that you would add to that Justin?

Justin Lee Firestone: Working with those guys, specifically during my Marquis Jet days, was an incredible experience. I think the key here is creating a brand—a brand that folks understand if you’re going to use a private jet service like Asia Jet—just like Marquis Jet or NetJets.

Whether or not NetJets decides to base aircraft in Asia, they’ve got their work cut out for them just by having a business that’s thriving in the U.S. right now and in Europe and in the Middle East. So in the interim, we’ll cover the clients when they come over here as much as we can. We’re all friends. So who knows what the future holds?