In the early 2000s the concept of destination clubs was a hot topic. Elite travelers joined often paying a six-figure sum and then more moderate annual fees. For this they received access to dozens and in some cases hundreds of homes, villas and apartments around-the-world for a specific amount of days per year. For the most part members had no equity in these properties or companies. For numerous reasons the concept went from frenzy to freefall and while there are several players that have had enduring success, the concept has never returned to its levels of a decade ago.

Alistair Ballantine (below) at the time was Chief Executive in North America for Abercrombie & Kent, the luxury travel company that also entered into the destination club segment. He went on to head the marketing for Orient-Express Hotels, Trains and Cruises and Oberoi Hotels & Resorts for North America.

The industry veteran has now reunited with former A&K colleague David Rogers to expand Rocksure on this side of the pond.

While Rocksure may be inspired by the destination club concept, it is in fact a “shared equity ownership of villa and vacation home portfolios.” Ballantine describes it as “the opposite of a destination club.”

Instead of memberships Rocksure is a series of real estate funds. The funds typically each have 45 to 174 investment units, although one can buy multiple shares or partial shares depending on the fund. Each has different terms. Money from the first 10 shareholders of a fund goes into escrow until the first property is purchased, typically after about three months. In the meantime shareholders of that fund can request usage of properties in sister funds. As more money is raised, more properties are purchased. As a shareholder you get to use the properties in your fund for a total of 21 days per year in seven day increments for resort properties and seven, three or four day segments for city properties.

Ballantine says even when funds are fully subscribed, maximum owner usage only equates to 75 percent of the calendar so there is flexibility to use inventory from sister funds, and owners generally get the property they request when they request it. The company also has a system in place so if one year you had Paris for Christmas, the next year you would have to wait to request that property for the same week until other owners have had a chance to put in their requests.

City properties have daily maid service while resort villas come with maids, cooks and gardeners. There is a service charge Ballantine describes as in the range of 100 Euros but no other charges. At the end of 10 years, the properties are sold and any gains are split among investors. The net result is over 10 years owner’s get 210 days of luxurious accommodations with the potential that based on appreciation those stays may end up gratis.

Apartments are located in city centers and are a minimum two bedrooms and 1,500 square feet while villas are five to six bedrooms, and Ballantine says the properties are all luxury level.

Does it work? The first fund launched in 2005 is approaching the end of its life, and despite properties having been acquired during the boom it looks like investor owners will make a small profit on their individual investments. He says several have already signed up for new funds.

Below is an overview of the various offerings:

London

- The Fund is divided into 64 Full Units of 1,000 shares per Unit. The first 12 Units will be offered at a discounted cost of £235,000 per Full Unit with subsequent Units valued at an initial price of £245,000. No borrowings are planned.

- After initial Closing has taken place, the minimum investment is a Half Unit at £122,500. Three-Quarter Units may also be subscribed for at £183,750. There is no upper limit of investment.

Crystal Fund

- The Fund is divided into 45 Full Units of 1,000 shares per Unit for which the current price is £238,000. Half, Three-Quarter and Multiple Units may also be subscribed for. No borrowings are planned.

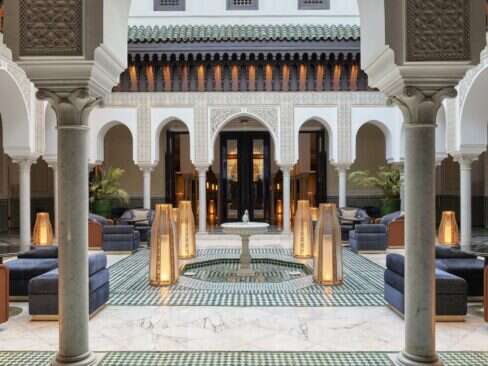

- The Fund will acquire a total of six 4-5 bedroom, 4-5 bathroom houses (average purchase price £1m – £1.5m) in different climate zones, thus providing Shareholders with ‘A House for All Seasons’. The selected destinations are Andalucía (southern Spain), Marrakech (Morocco), South West Turkey, The Algarve (Portugal), Provence (France) and Antigua (The Caribbean).

- The Fund has now purchased a magnificent house in Andalucía and has entered into arrangements to acquire an impressive modern property overlooking Nonsuch Bay in Antigua. Both properties are now available for use by Crystal shareholders. Early Investors also have immediate use for a limited period of all Rocksure-owned villas shown on www.rocksure.com using their Crystal Fund entitlements.

Capital Fund

- The Fund is divided into 170 Full Units of 1,000 shares per Unit for which the current price is €135,000. The minimum investment is a Half Unit. No borrowings are planned.

- The Fund has now purchased apartments in Paris, Barcelona, Prague and Vienna; all are wonderfully spacious, and very well-located. A penthouse apartment with a private terrace overlooking the Ponte Vecchio in Florence is also available to Shareholders, as is a smart apartment near Buckingham Palace in London. All properties can be seen at www.rocksure.com/funds/capital-fund

Manhattan Fund

- The Fund is divided into 64 Full Units of investment. The first 12 Units will be offered at a discounted cost of $335,000 per Full Unit with subsequent Units valued at an initial price of $350,000. No borrowings are planned.

- After initial Closing has taken place, the minimum investment is a Half Unit at $175,000. Three-Quarter Units may also be subscribed for at $262,500. There is no upper limit of investment.

Liberty Fund

- The Fund is divided into 75 Full Units of investment. The first 12 Units will be offered at a discounted cost of $280,000 per Full Unit with subsequent Units valued at an initial price of $295,000. No borrowings are planned.

- After initial Closing has taken place, the minimum investment is a Half Unit at $147,500. Three-Quarter Units may also be subscribed for at $221,250. There is no upper limit of investment.

- The Fund will purchase six 2-bedroom, 2-bathroom apartments or town houses in New York, Washington DC, Miami, San Francisco, Chicago and Santa Monica. Each property will be spacious (approximately 1,500 ft². / 140 m².), luxuriously-furnished and centrally located.