Classic car prices continued to grow in 2021, with an estimated 20% rise in the number of transactions, and rising values paid. Supply chain delays, inflation and the growing wealth of HNWs all helped fuel the classic car market.

Online auctions have of course soared over the past two years, allowing potential buyers to bid on classic cars from any location. Data from Hagerty US, which specializes in collectible car analytics, shows that in 2020 the value spent on online car auctions doubled from 2019. Then it doubled again in 2021, racking up over $1bn.

But auctions still make up a very small segment of the classic car collector market – private sales make up 87% of transactions. This has barely changed since before the pandemic, despite the growth in online auctions.

[See also: Bentley Bentayga Hybrid: A Glimpse into the Near Future]

Which classic cars performed best in 2021?

Hagerty’s analysis found that 1980s cars dominated the list, topped by the 1998-1991 Honda Prelude. The Hagerty Price guide places an average “condition 2” Prelude at $23,800, an 89% price increase from January 2021.

The third-generation Prelude reached the global market in 1988, featuring many of the stylistic features of its forebears. It was widely lauded in competitions of the year, one of the best performances yet seen of a Japanese car.

“Japanese cars have been hot for a few years now, but in 2021 the previously overlooked cars of the segment gained attention, as buyers look elsewhere when they’re priced out of their first choice or they want something more unique,” Hagerty's valuation analyst Adam Wilcox says.

Z cars also dominated 2021’s biggest winners: both the 1978-1983 Datsun 280ZX and the 2003-2008 Nissan 350Z, which both saw around 80% price growth during 2021.

The Datsun 280ZX was the newer, flashier successor to the Datsun 240Z, which redefined sports cars in the late 60s. The 280ZX was famously raced by actor Paul Newman, and his race-winning model was restored and put up for sale in 2020 for $7m.

The 280ZX received a few performance upgrades in the early 1980s, adding more power, better brakes and better suspension. It is these later models that are most in-demand at auction.

The Datsun 280ZX saw over 80% price growth / ©Getty Images

“The most desirable Zs have been increasing in value a lot in recent years, so many collectors who have been priced out have started to look at the less-desirable Z models, which has increased demand and increased those values,” says Wilcox.

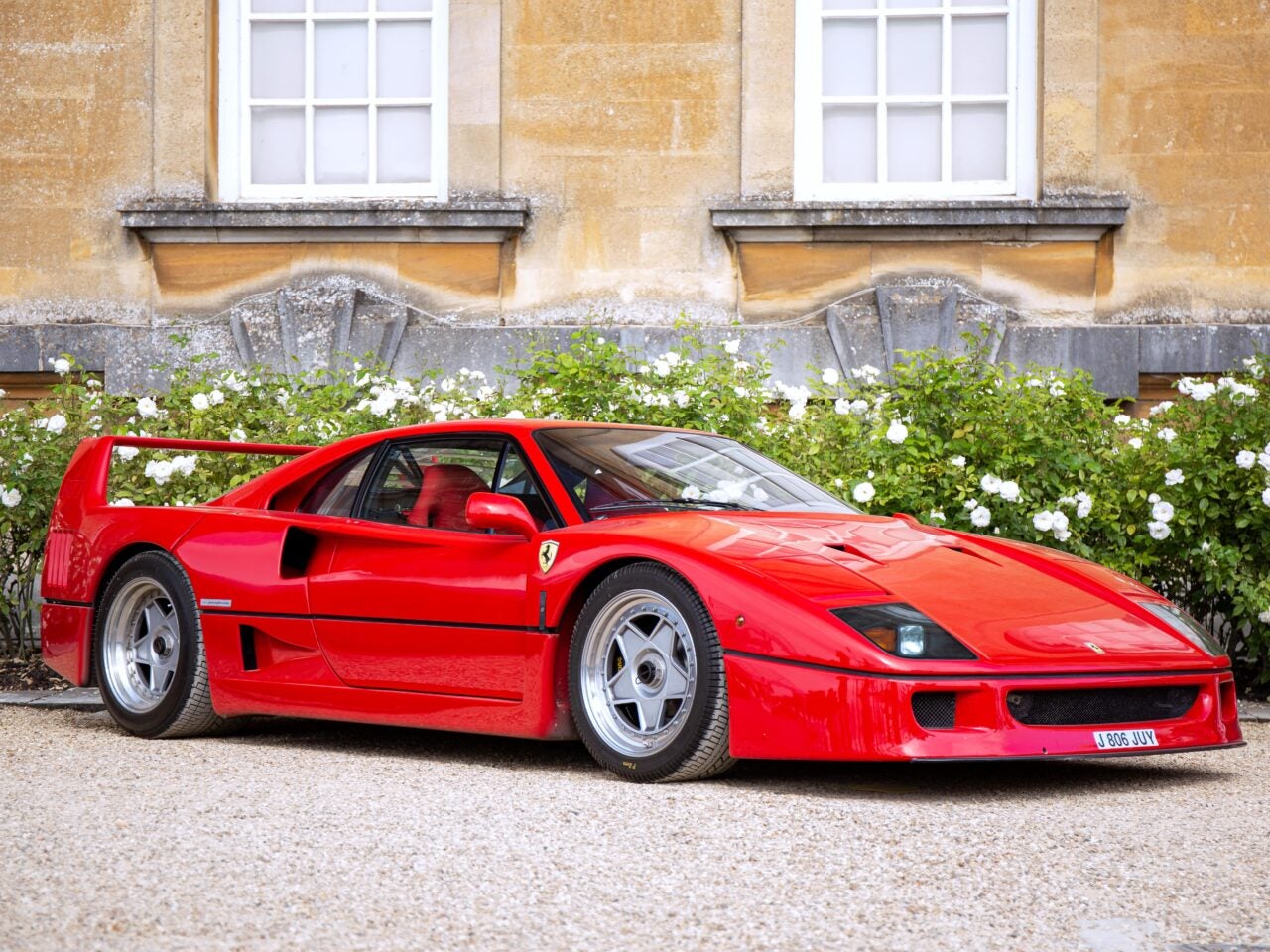

A couple of analog supercars from across the decades made 2021’s top performers, and are the most expensive cars listed by a long shot – the 1987-1992 Ferrari F40, the 1995-1997 Ferrari F50 and the 2011-2012 Lexus LFA.

“Anyone watching the market recently won’t be surprised to see analog supercars sell for big money,” Wilcox says. “It’s likely, as electrification and its silent performance continues to take over the market, that the sounds of internal combustion engines will make them more desirable.”

The Ferrari F50 is one of the world's most valuable classic cars / ©Getty Images

The F40 and F50 are considered by many to be perhaps the best supercars of all time and the Hagerty price guide estimates their average price to be $2.4m and $3.5m respectively, with growth topping out at 70% in the past year.

Ferrari built just 1,315 examples of the F40 between 1987 and 1992. By the time 200 cars reached the US in early 1990, its reputation had already grown to gargantuan proportions and models sold for three times the list price. The F40’s legacy has barely faltered since and any on the market sell quickly, no matter the price.

In 1996, Ferrari released the F50 to celebrate its 50th anniversary. With only 349 cars produced, the F50 epitomized exclusivity from the word go, and that has stayed true to this day.

[See also: The Data Behind the Electric Car Market's Explosive Growth]