When you’re looking to make an investment, numbers are important. But a growing number of investors are increasingly looking beyond the traditional, bottom line figures and requesting non-financial information on aspects such as how companies are targeting climate change, embracing diversity or tackling equal pay before making investment decisions.

This type of investment strategy may be referred to by a few different names – like environmental, social and governance investing (or ESG investing, for short), socially responsible investing or mission-based investing. While there are distinctions between those terms, there’s no doubt this type of strategy is becoming increasingly popular.

But what is ESG investing, and how can you incorporate it into your portfolio?

Abigail Pohlman, head of the sustainable solutions group for Goldman Sachs Private Wealth Management, discusses ESG investing and how individuals can support this type of investment strategy.

The Weekly Wrap from Goldman Sachs Private Wealth Management

Find out what’s moving the markets click hereWhat is ESG investing?

It can simply be defined as investing that incorporates sustainability principles and ESG criteria into the investment decision-making process. ESG stands for environmental, social and governance.

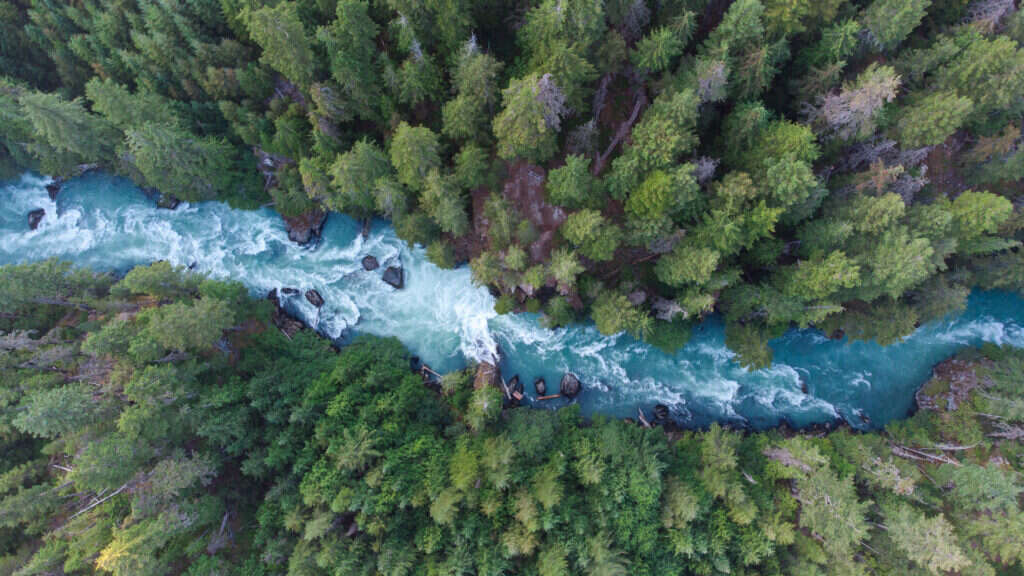

Environment measures how business practices impact the world’s ecosystems – the air, the land, the water of our local and global communities. Social considers the wellbeing and safety of employees and how businesses are interacting with the communities in which they operate. Governance evaluates the ethics and longevity of corporate management. They’re really asking: “How well is this business run?”

ESG can mean many different things to different people. There is no agreed-upon definition of these specific criteria. Investors can focus broadly on a full suite of ESG criteria or focus in on a narrow set of one or two criteria that mean the most to them.

What does ESG investing look like at Goldman Sachs?

At Goldman Sachs we believe that ESG and sustainable investing are, first and foremost, investing. What that means is we think sustainable investing requires the same discipline and the same rigor as any other investment strategy, while still focusing on the goal of achieving financial returns.

We believe that the best strategies start by really understanding what our clients’ objectives are. Their ESG and investment objectives and then identifying what’s available as an investable opportunity in the market.

Goldman Sachs has a tradition of environmental stewardship that goes back decades. In 2019, we made a 10-year commitment of $750 billion in financing, investing and advisory activities to address climate change and to achieve sustainable and inclusive growth. By the end of 2020, we were very proud to announce that we had achieved more than 20% of our sustainable finance goals.

Finally, Goldman Sachs is committed to being an active participant in ESG efforts, which includes providing the necessary resources for our clients to incorporate ESG factors into their investment strategy.

What are some misconceptions about ESG investing?

There is a misconception that you must sacrifice returns in order to help make a positive impact. Goldman Sachs takes the position that ESG strategies not only perform well relative to their non-ESG counterparts, but in some cases they also have had the opportunity to outperform.

In many cases ESG is really just a matter of “good” investing. For example a company that has better environmental policies and procedures is going to open itself up to some cost savings associated with water usage, potential permitting delays and legal costs.

Similarly a company that has a more diverse leadership team and workforce has the potential to see lower recruiting costs, higher innovation and potentially higher productivity.

It’s also important to be wary of labels around ESG. Just because a strategy is labeled as “ESG” or “sustainable” does not mean that it’s a pure, 100% ESG strategy. And it may not meet your definition of what ESG is.

Take an ESG mutual fund. There may be some non-ESG investments within the fund, and there may not be a suitable ESG option to fulfill a specific need across the entire mutual fund’s investment criteria. Even though the fund may not take a pure approach, it’s still going to favor ESG investments and it’s going to “tilt” toward investments that are incorporating these factors.

How can I get started with ESG investing?

It’s important to get a good understanding of what ESG means. But, at the same time, knowing what ESG means to you and to your particular investment strategy. There’s not a one-size-fits-all approach, and you should make sure you know what your goals are before you get started.

The good news is there are an expanding number of options and ways to incorporate ESG into your investment portfolio. And ESG funds really make it easier than ever to tilt your portfolio toward a sustainable investing lens.

It’s also important to really recognize that big changes can start with very small steps. We very much view approaching ESG investing as a process and not a singular act. If you try to be a purist and do everything at once, you will likely be setting yourself up for some disappointment.

As more and more investors gravitate toward ESG investing, there will definitely be more research available to investors. From our perspective, it is a very exciting time to get started.

General Disclosure

This article is for informational purposes only and shall not constitute an offer, solicitation, or recommendation to buy or sell securities, or of an account type, securities transaction, or investment strategy. This article was prepared by and approved by Marcus by Goldman Sachs®, but is not a description of any of the products or services offered by and does not reflect the institutional opinions of The Goldman Sachs Group, Inc., Goldman Sachs Bank USA, Goldman Sachs & Co. LLC or any of their affiliates, subsidiaries or divisions. Goldman Sachs Bank USA and Goldman Sachs & Co. LLC are not providing any financial, economic, legal, accounting, tax or other recommendation in this article and it is not a substitute for individualized professional advice. Information and opinions expressed in this article are as of the date of this material only and subject to change without notice. Information contained in this article does not constitute the provision of investment advice by Goldman Sachs Bank USA, Goldman Sachs & Co. LLC are or any of their affiliates, none of which are a fiduciary with respect to any person or plan by reason of providing the material or content herein. Neither Goldman Sachs Bank USA, Goldman Sachs & Co. LLC nor any of their affiliates makes any representations or warranties, express or implied, as to the accuracy or completeness of the statements or any information contained in this document and any liability therefore is expressly disclaimed.

Investing involves risk, including the potential loss of money invested. Past performance does not guarantee future results. Neither asset diversification or investment in a continuous or periodic investment plan guarantees a profit or protects against a loss.

Investment products are: NOT FDIC INSURED ∙ NOT A DEPOSIT OR OTHER OBLIGATION OF, OR GUARANTEED BY, GOLDMAN SACHS BANK USA ∙ SUBJECT TO INVESTMENT RISKS, INCLUDING POSSIBLE LOSS OF THE PRINCIPAL AMOUNT INVESTED